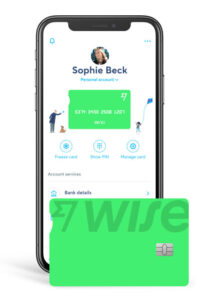

Wise is a digital financial services entity that offers a money transfer process that is simple, secure and faster:

Wise is a unique digital bank offering a free multi-currency account to customers. Previously called TransferWise, it was set up in 2011 in London by 2 Estonians, Taavet Hinrikus, who was incidentally Skype’s first employee, and Kristo Käärmann, a financial consultant who had worked for Deloitte. Its system, akin to the home-grown hawala money transfer, provides besides the free multi-currency account, currency conversion at the average daily rate, and money transfers between banks, organizations and individuals. It supports transfers among 80 countries, and 54 currencies can be stored on the account.

The neobank offers all standard features and services free of cost up to a limit. A customer can store up to €15,000 but if it exceeds this limit, there is a fee of 0.40% per year, and if the customer withdraws from ATMs more than £200 per month, there is a fee of 1.75% for each subsequent withdrawal. Wise operates under a valid license and is regulated by the U.K.’s FCA and FinCen.

SIMPLE PROCEDURES

The neobank offers a simplified registration via email or social media accounts. A customer is given a standard Mastercard debit card that is accepted for payment in all countries and at most ATMs. The multi-currency account has no restrictions or limits on the storage of funds and the customer can opt for a priority currency for payment. The mobile app that is offered has a simple interface that work in several languages.

A customer can accept direct payments in 7 global currencies and payments in other currencies are automatically converted to those currencies that the customer prefers. Currency conversions are made at the average daily rate and not at the spot rate, which many experts consider is most advantageous for currency exchange.

Any individual or a legal entity can open a Wise account. An entrepreneur account has an extended set of services and it allows the account holder to pay bills of counterparties, engage in e-commerce, make batch payments to employees and automate tax reporting.

SOME DRAWBACKS

However, there are some disadvantages like there is no interest paid on deposits and there are no overdrafts or lending services offered, although a bank account is provided free of charge.

What attracts customers is the conveniences that comes with a Wise account like having a secure multi-currency wallet, which can be of major advantage for global travellers or businessmen operating in different countries.

INTEGRATION WITH SWIFT

Wise has recently launched a new SWIFT International Receive service that allows customers to undertake cross-border payments, even if their bank accounts are not connected to SWIFT. Perhaps, Wise is the first neobank to be on the SWIFT platform. It said with this new facility, it will make it easier for other neobanks to connect, and enable their customers to efficiently and safely receive international payments through SWIFT using their existing account details. The feature also enables financial institutions with an existing SWIFT setup to switch to Wise’s service and receive incoming SWIFT payments more quickly, cheaply and conveniently.

A PUBLIC COMPANY

Wise came out with an IPO in July 2021 and went public with a direct listing on the London Stock Exchange. It was then valued at $11 billion. Goldman Sachs and Morgan Stanley were the joint global co-ordinators for the IPO.

Wise had received seed funding amounting to $1.3 million from a consortium, including venture firms IA Ventures and Index Ventures, IJNR Ventures, NYPPE as well as individual investors such as PayPal co-founder Max Levchin, former Betfair CEO David Yu, and Wonga.com co-founder Errol Damelin. Subsequently, it had several rounds of funding and as of 2016, raised a total of $117 million. Subsequently, it raised $280 million in 2017 and received an investment round of $290 million in 2019, getting a valuation of $3.5 billion. It also received a secondary investment round in 2020 of $319 million and reached the total valuation of $5 billion.

When war broke out between Russia and Ukraine, Wise became an effective platform for Ukrainian nationals to transfer cash for supporting relatives who had to flee the country.

Wise claims it is building money without borders – making it move faster, more conveniently, and eventually for free and powering money for people and businesses to pay, to get paid, to spend, in any currency, wherever one is, whatever one is doing.

It says there are 3 things about sending money:

- It should be low-cost and fair and Wise offers the real exchange rate which is the fair one.

- It should be easy and stress-free to send money no matter how far it’s traveling.

- It should be fast as sending an email and at Wise it takes a few minutes to set up an account and make a money transfer instantly.

___________________________________

Read more-

Skipton International launches limited company buy-to-let lending