bunq, the second-largest neobank in Europe, has partnered with Mastercard to provide its 12.5 million users with a holistic view of their finances. This collaboration […]

Tag: Neobank

A digital only bank that is almost a universal bank

Rakuten Bank is Japan’s digital only bank that provides all the banking services, including deposits, loans, exchange transactions, investment trusts, securities, credit and cash cards, […]

Dutch neobank Bunq makes a play for the insurance market

bunq, Europe’s second-largest neobank, has announced significant upgrades to its user experience with the launch of a fully conversational AI assistant named Finn and the […]

UNObank, a new star in the Philippine banking horizon

It has big plans and financial inclusion is the core theme: UNObank, a new star in the Philippine banking horizon It has big plans and […]

bunq Revolutionizes European Banking with GenAI Platform, Finn

Amsterdam, December 19, 2023 – In a groundbreaking move, bunq, the second largest neobank in Europe, has unveiled Finn, its proprietary Generative AI-driven platform, […]

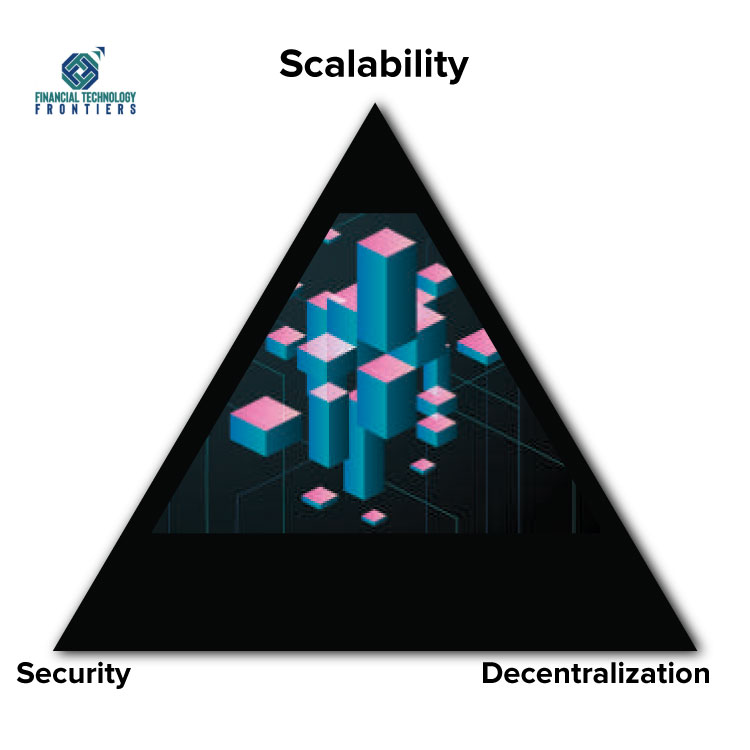

Use of DLT set to redefine the role of banks

Distributed Ledger Technology is now vastly used in many banking functions and there is some sort of a threat that banks may change the way […]

Bluevine offers unmatching conveniences to SMEs

Bluevine is an exception among neobanks, it offers interest on deposits, its rates of interest for loans are comparatively low and it accepts cash deposits: […]

Fintech and Neobank under the same Umbrella

Bank Leumi is Israel’s oldest bank, having founded in 1902 as a subsidiary of the Jewish Colonial Trust. Its primary aim was to promote industry, […]

Current builds tech that appeals to Gen Z

US neobank Current has been able to attract millennials and Gen Z customers with its unique offerings: New York City-based neobank Current is uniquely offering […]

The challenge of digitizing an Islamic bank

Emirates NBD, Dubai’s government-owned bank and one of the largest banking groups in the Middle East in terms of assets, is considered as a pioneer in adopting disruptive technologies designed to transform banking operations and to offer extreme customer delight. The bank has an embedded culture to continually innovate and move to newer levels. It has made significant investments in new technologies so that its technology infrastructure is state-of-the-art and it could make major breakthroughs in digitization.