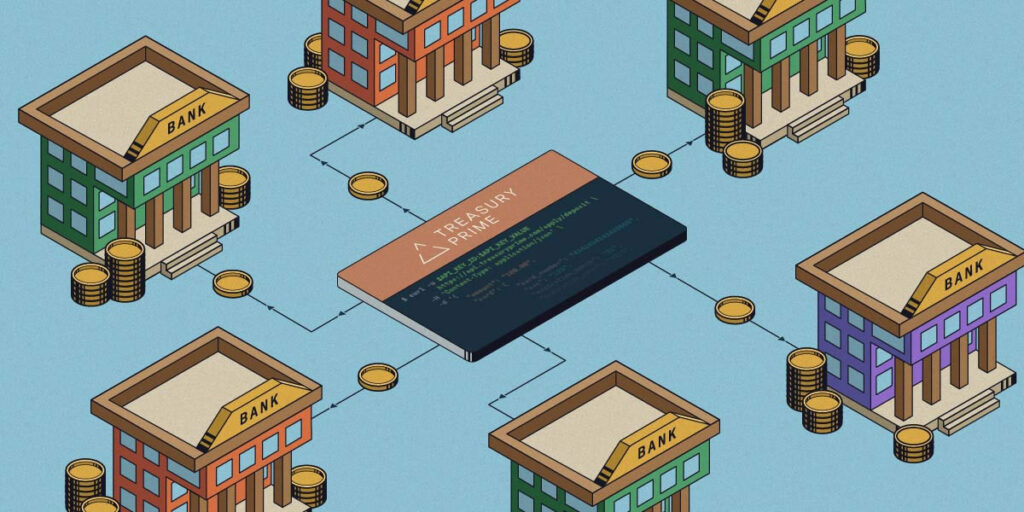

In a strategic move aimed at reshaping the landscape of fintech partnerships, Treasury Prime, a leading provider of embedded banking software, announces the launch of its Bank-Direct product and a series of initiatives designed to bolster support for banks and credit unions.

Chris Dean, CEO and co-founder of Treasury Prime, emphasizes the pivotal role of direct partnerships between regulated institutions and technology firms in shaping the future of banking. With a focus on the “bank-direct” approach, Treasury Prime aims to facilitate seamless collaboration between banks and fintechs to deliver innovative financial services across new channels and applications.

The Bank-Direct product, a cornerstone of Treasury Prime’s offerings, facilitates real-time collaboration between banks and fintech partners. Equipped with self-service tools and features, banks can access actionable insights, customize risk controls, and foster joint collaboration with fintech partners through a unified dashboard.

Key initiatives under the Bank-Direct strategy include:

- Sales Strategy Enhancement: Treasury Prime is refining its sales strategy to empower banks in closing deals independently. Automated screening tools and a dedicated business development team will assist banks in identifying and partnering with fintechs that align with their objectives.

- Platform Implementation and Customer Onboarding: Efforts will be accelerated to streamline contracts and regulatory compliance processes, ensuring that banks maintain oversight of their fintech customers while optimizing the onboarding experience.

- Flexibility and Tailored Partnerships: Treasury Prime is committed to providing banking institutions with greater flexibility to customize partnerships with fintech customers, thereby deepening relationships and building their own fintech brands.

- Investments in Infrastructure: Optimal investments in personnel and infrastructure will drive the expansion of bank-led fintech and embedded banking partnerships, underpinning Treasury Prime’s commitment to industry transparency and compliance.

Jeff Nowicki, Chief Banking Officer at Treasury Prime, underscores the company’s unique position in strengthening bank-led fintech relationships. The modern, API-driven infrastructure provided by Treasury Prime empowers banks to seamlessly distribute products through fintechs or embed them in various channels.

As the fintech marketplace matures, regulatory expectations for robust oversight and compliance have increased. Treasury Prime’s bank-direct approach aligns with these evolving regulatory requirements, providing banks with the tools and resources needed to effectively manage fintech partnerships.

Sheetal Parikh, General Counsel and Chief Compliance Officer at Treasury Prime, emphasizes the importance of direct oversight in creating a safer and more sustainable ecosystem for banks, fintechs, and partners alike.

Treasury Prime remains committed to providing dedicated support for all parties on its Banking as a Service (BaaS) operating system. However, its intensified focus on bank-direct initiatives reflects a strategic response to industry dynamics and regulatory imperatives, positioning Treasury Prime as a catalyst for transformative fintech partnerships in the embedded banking space.

Read more: Magnati & Biz2X Partner to Launch UAE’s Largest AI-Powered SME Lending Platform