The KeyBank 2023 Financial Mobility Survey, released on Monday, finds that Americans are in a difficult financial situation, with 55% facing financial challenges in the last year, a significant increase from the previous year (37%), and more than double the number of respondents citing budgeting issues as their biggest financial faux pas (89% vs. 35%, respectively). Yet, even as Americans face these challenges, the majority (85%) strongly desire to become more aware of their financial picture.

The KeyBank 2023 Financial Mobility Survey, released on Monday, finds that Americans are in a difficult financial situation, with 55% facing financial challenges in the last year, a significant increase from the previous year (37%), and more than double the number of respondents citing budgeting issues as their biggest financial faux pas (89% vs. 35%, respectively). Yet, even as Americans face these challenges, the majority (85%) strongly desire to become more aware of their financial picture.

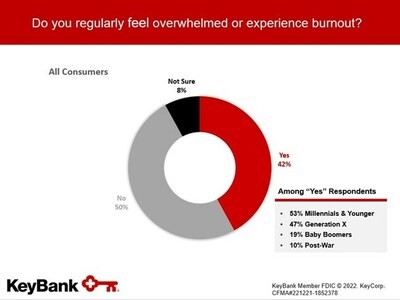

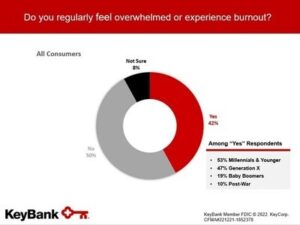

Mitch Kime, Executive Vice President of Consumer Client Growth at KeyBank, one of the US’s largest bank-based financial services companies, said, “More people have experienced a loss of income, fewer feel financially savvy, and burnout is rising among younger respondents. Given the current economic climate, it’s no surprise that Americans want to take control of their finances.”

The survey polled more than 1,000 Americans: Two in five people (42%) reported feeling overwhelmed or burned out regularly, with Millennials or younger (52%) and those under 35 (54%) experiencing burnout more acutely. The top three things that will make consumers feel more financially resilient in 2023 are financial information (55%, up from 48%), digital banking tools (47%, up from 39%), and advice from a financial advisor (36%, up from 29%)—edging out a good night’s sleep (30%, down from 43%).