Advanced analytics, AI and ML help the Nigerian commercial bank to identify and manage risks more effectively:

Wema Bank is a Nigerian commercial bank, licensed by the Central Bank of Nigeria. It is the pioneer of Africa’s first fully digital bank, ALAT, and one of Nigeria’s most resilient banks. It serves over one million individuals, families, and businesses across Nigeria, helping them achieve their personal and financial goals.

Adekunle Frank Alarapon, Head – Retail Segments at Wema Bank, is a professional with certifications in banking, product development, strategy, ICT, research methodology, and sales. His forte is in creating new businesses and building ecosystems with the use of modern-day technology. He has done BTech and MBA.

Mehul Dani: What are the changes made in the digital strategy for customers of your bank in the current FY? How has your bank benefited from the implementation of digital strategy in recent years?

Adekunle Alarapon: Wema Bank is continually driven towards becoming fully digital in its thinking, approach, operations, and ways of doing business. Hence, our strategies are geared towards eliminating every element of traditional banking through customer growth and sales optimization, channel migration, value chain optimization, and customer lifecycle management. The aim is to use technology to drive the achievement of these objectives through automating manual processes, creating personalized customer experience, and using smart infrastructure, big data, AI, ML , cybersecurity & cloud-based services.

We also leverage open banking and APIs to share customer data securely with trusted third-party providers, leading to improved CX, expanded product offerings, and new revenue streams.

All these have created immense benefits to the bank such as reduction in TAT, enhanced efficiency across digital applications, improved CX, and increased rate of customer acquisition and retention.

Please describe the key being used by the bank technologies of your bank and the usage pattern among customers.

Customers can carry out end-to-end account opening and transact on the bank’s digital channels (*945#, ALAT & ALAT for Business) without having to visit any of the branches. About 75% of the customers have embraced using one or more of the bank’s digital platforms. This is owing to the convenience, security, user-centricity, and reliability of the platforms.

Based on usage pattern, 45% of transactions carried out on the platforms are fund transfer. Airtime, data & bills payment take about 30%. Other activities include request for loan, card control, account statement generation, use of virtual cards, and savings and investments.

With the increasing digital threats, the bank employs robust cybersecurity measures by implementing multi-factor authentication, encryption, and fraud detection systems to protect customer data, transactions, and the bank’s reputation. Advanced analytics, AI, and ML technologies help the bank to identify and manage risks more effectively, such as credit risk assessment and compliance monitoring.

How much business has been garnered online by your bank as of March 2023? How have you brought distributors, and agents, into the fold of your digital strategy?

ALAT, our mobile app, reported an aggregate net income of 886 million in Q1 2023, an increase of 56 million (6%) from the Q4 2022. Yoy net income grew to 1.3 billion naira from Q4 2021 to 1.8 billion in Q1 2023 (28%).

In the Lagos region, we have one of the thriving fintechs as one of the topmost customers, in the eastern region, we have a customer in the real estate business, and in the northern region, a customer in the agricultural sector. We provide these customers with mouth-watering value-added services that help them make seamless transactions on our platforms.

ALAT initiatives have provided a more convenient banking experience for customers through online banking, mobile apps, cards, and other digital channels. We have been able to reach more customers, even those in remote locations, through partnerships with fintechs, agency banking, social media campaigns, etc. We have streamlined processes and reduced costs through automation, such as using net promoter scores and 24×7 contact centre support. We have increased security and reduced fraud through enhanced authentication methods, such as biometrics and 2-factor authentication.

Who are your 3 main tech vendors and which are their services? Share details about the data center, networking and size of your IT team.

(i) BBT provides support and maintenance for Cisco Smartnet and disaster recovery infrastructure. (ii) AEG Support and Services offers SWIFT maintenance and support. (iii) Infosys supports and maintains the Finacle core banking application.

The IT team currently comprises 116 professionals in information security & compliance, IT service management, business process engineering, application support & management, system administration, software development, business analysis and project management. The bank’s data centre is situated at the head office location, and it is back bone of the bank’s operation, providing secure and scalable storage solutions for the bank’s vast amount of data. The data centre houses physical servers & cloud-based servers, networking equipment, including routers, switches, firewalls, and load balancers. It implements robust security measures to protect sensitive data and ensure regulatory compliance and plays a crucial role in disaster recovery and business continuity planning.

The IT team currently comprises 116 professionals in information security & compliance, IT service management, business process engineering, application support & management, system administration, software development, business analysis and project management. The bank’s data centre is situated at the head office location, and it is back bone of the bank’s operation, providing secure and scalable storage solutions for the bank’s vast amount of data. The data centre houses physical servers & cloud-based servers, networking equipment, including routers, switches, firewalls, and load balancers. It implements robust security measures to protect sensitive data and ensure regulatory compliance and plays a crucial role in disaster recovery and business continuity planning.

What is the capex and opex growth for digital initiatives?

Compared with the last year, capex and opex have increased by 35% and 28% respectively. This is due to the investment in smarter technologies, strategic hiring, training of IT staff, and maintenance of existing infrastructure.

What has been the impact of analytics on the business?

Over the course of the past years, the Data Analytics team has been able to incorporate modern advanced analytics and artificial intelligence technologies like Python, Power BI, and SQL, to provide valuable insights and facilitate sound decision-making.

The data analytics department was able to lower the churn rate by keeping 78% of these clients by using the ALAT Churn Prediction Model. There is also the Product Recommendation Model, which enables the bank to cross-sell digital products to its customers who are not currently using digital platforms, resulting in the onboarding of new consumers and increased conversion rates by 17.2% on USSD and 5.18% on the ALAT app.

The data analytics team also leverages an internal application called Databox, reducing the cost of Power BI licenses for 584 users at $10 per user per month by half. Additionally, it has aided in the democratization of data throughout the bank and works as a tool for data visualization.

The introduction of Datathon (a data literacy-driven event) has been able to gradually advance data literacy throughout the bank, providing the bank’s employees with the ability to advance their data knowledge and expertise by exposing them to data analytic tools and policies that regulate data.

Which technology is used for CRM? How are you boosting CX?

For customer relationship management, the bank has a state-of-the-art technology that allows the bank to collect, store, and manage vast amounts of customer data relating to contact details, transaction history, preferences, and interactions. Also, the technology makes it easy to segment the customer base using various criteria, such as demographics, purchasing behavior, or preferences, and allows for analysis of customers’ data for targeted marketing campaigns, personalized communications and relevant offers to specific customer segments. This improves engagement and response rate.

The CRM is integrated with multiple communication channels, such as email, social media or live chat. It offer reporting capabilities to measure key performance metrics, track customer satisfaction, and identify trends and patterns.

What online marketing & promotional efforts has the bank undertaken for the current FY and planned for the next FY?

A lot of marketing communications and investor relations happen on social media channels. The bank is ranked on LinkedIn Top Companies. As of June 5, 2023, Wema Bank (together with ALAT by Wema) has 52,977 followers on LinkedIn, over 292K on Instagram and over 200K on Twitter.

Wema Bank has a presence on all the major social media platforms for building and strengthen the brand presence and increase awareness and trust. The bank also runs campaigns that drive traffic to the websites, landing pages, or lead generation forms, generating qualified leads for further engagement.

Since the beginning of the year, there have been targeted communications and aggressive engagements on the social media platforms. In April 2023, the bank launched an online challenge called the Sound of ALAT with focus on people between 18 and 35 years. Beside hundreds of entries for the challenge, the attention drawn and tractions gained were massive.

The bank is leveraging technology to achieve social selling, customer acquisition, customer education, financial literacy, customer feedback, reputation management, social listening and market intelligence.

Which IT initiatives have led to an increase in business and productivity? What are your targets and plans for the current year?

In May 2023, ‘Phygital’ was deployed. Phygital is a self-service, in-branch digital solution that combines both physical and digital aspects of banking to create a seamless experience for the bank’s customers. It is equipped with tablets that allow customers to transfer funds, update account information, hotlist their cards, request & get account statements and letter of non-indebtedness without the intervention of the bank’s officers.

Over 500,000 manhours have been saved and over 70% reduction in TAT through self-service is recorded for transactions that would have required 2 staff members with an average of 7 minutes TAT. Within the first 3 weeks of launch, over 15 billion transactions were carried out with over 100,000 paperless transactions and seamless customer interaction. The platform is also leveraged to drive adoption on ALAT/ALAT for Business.

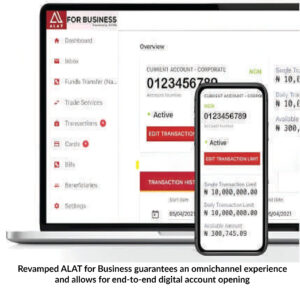

Worthy of note is the launch of a revamped ALAT for Business (an internet banking solution for corporates), which guarantees an omnichannel experience and allows for end-to-end digital account opening. The digital account opening capability of the platform now brings an average of 900 new-to-bank customers weekly and allows customers who are outside the country to have business relationship with the bank.

Worthy of note is the launch of a revamped ALAT for Business (an internet banking solution for corporates), which guarantees an omnichannel experience and allows for end-to-end digital account opening. The digital account opening capability of the platform now brings an average of 900 new-to-bank customers weekly and allows customers who are outside the country to have business relationship with the bank.

In the journey to digital dominance, Wema Bank continues to invest in IT infrastructure and initiatives. One of the bank’s overarching goals is to have 5 million active transacting customers in the year 2023.