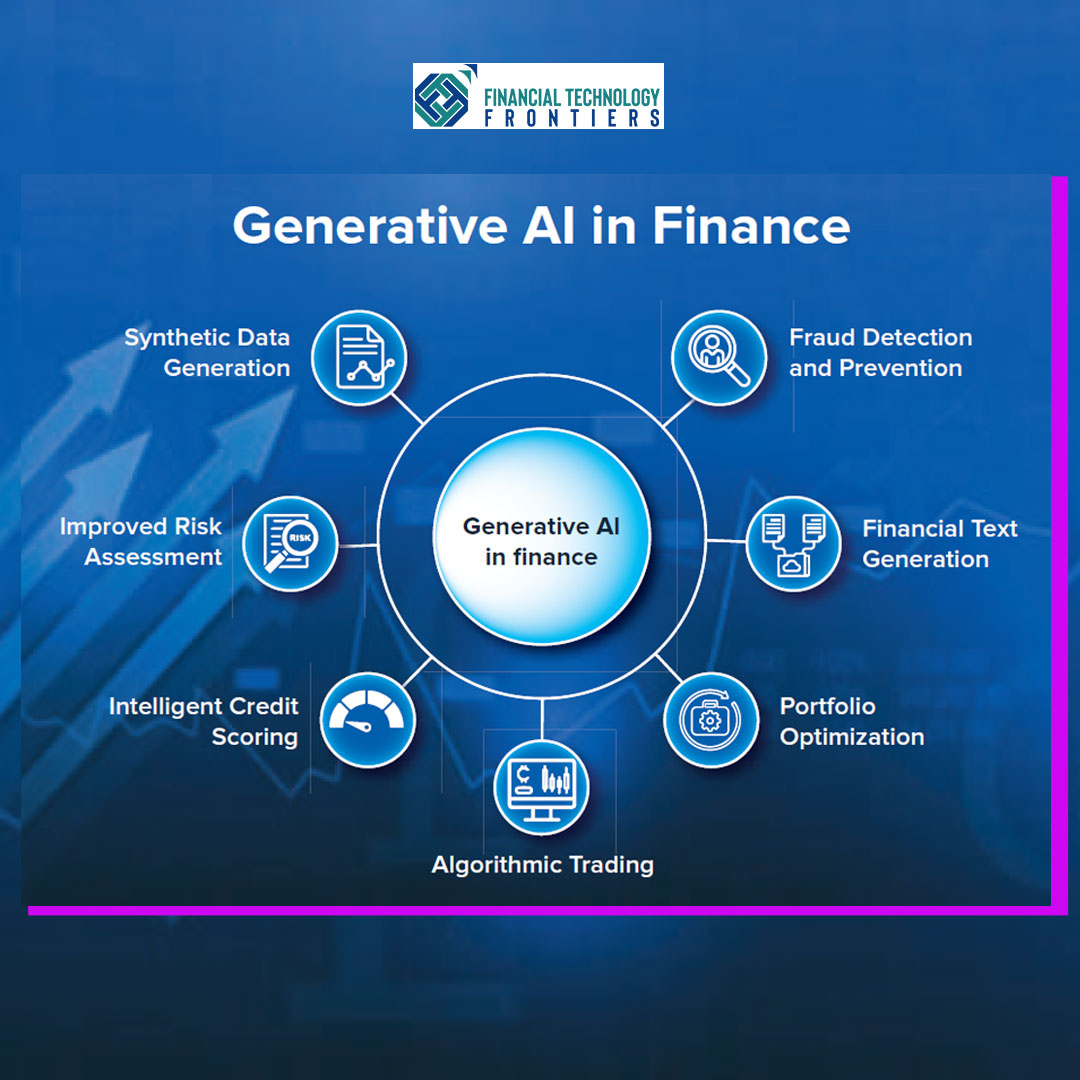

Banks have the choice of an efficient tool in Generative AI in handling domains as diverse as customer engagement or fraud detection:

While AI, or Artificial Intelligence, is no more a novelty in the banking sector, what has now captured the imagination of banking technology practitioners is Generative AI, with its varied use cases, ease of adoption and unprecedented benefits. As all of us know, the General AI aims to make use of human-like intelligence across any activity. There is a sub-sect to General AI, called Traditional AI or Narrow AI or Weak AI, which focuses on performing preset tasks using predetermined algorithms and rules. Traditional AI systems operate on set rules and instructions devised by human programmers.

Generative AI is considered as a branch of traditional AI, and has been in use since in 2014 in a rudimentary manner. Now, its uses are focused, more fine-tuned and highly beneficial. It is essentially concerned with the creation and development of new material. Generative AI differs from traditional AI in that it creates entirely new data that resembles human-created content, such as text, images, audio, video and even synthetic data.

A UNIQUE PRODUCT

One of the notable examples of Generative AI is ChatGPT, one of the best uses of conversational AI. It is a language model trained on huge amounts of textual data, which is capable of generating human-like responses to user prompts. As any user would vouch, it can create interactive and realistic conversations with users, making it a powerful tool for chatbots, virtual assistants and customer support applications, including in banking.

Generative AI generates new content by learning patterns from existing data, enabling the related systems to exhibit creativity and produce original outputs. While the new capabilities that are possible under Generative AI have created opportunities as wide as better movie dubbing and rich educational content, digitally forged images and videos, it has also found major and highly beneficial applications in the realm of banking and finance.

THE USER INTERFACE

Before discussing the use of Generative AI in the financial services sector, it is useful to understand how it works. In fact, it starts with a prompt that could be in the form of a text, an image, a video, a design, musical notes, or any input that the AI system can process. Various AI algorithms then return new content in response to the prompt. Content can include essays, solutions to problems, or realistic fakes created from pictures or audio of a person.

PERSONAL TOUCH SANS HUMANS

So, when it comes to BFSI, Generative AI is capable of analyzing huge amounts of data and produce unique insights and content at super speeds. This helps the bank staff to make informed and contextual decisions, provide personalized services, assess risk, et al. There is an estimate that the adoption of this technology can help the sector to save $340 billion annually through efficiency in operations, reducing human mistakes and saving operational costs. And what is more, it affords a personal touch in customer interaction without having to be reliant on humans.

One of the very basic uses of Generative AI in banking is in creating conversational banking through natural human languages, which means banks can evolve focused product offerings to different regions and at the same time ensure information consistency and support to different geographical audiences.

CUSTOMER HANDLING

It also offers major benefits to the banks while interacting with its customers. Using it, a bank’s technology team can create language models that are capable of conversing like humans. Instead of navigating through a series of choices, customers can directly ask ‘what is my balance’ or ‘change my address’ and receive solutions.

PORTFOLIO MANAGEMENT

Likewise, the technology allows banks to create a more focused approach when recommending portfolio strategies to their customers. The deep learning model first trains on vast economic data. Then, bankers use the AI system to predict future trends based on various changing financial variables and then offer a most appropriate portfolio. The customers need not divulge details of their current financial status, ensuring total privacy.

COMPLIANCE DOMAIN

Its applications can facilitate compliance management. The concerned staff, using these applications, monitor transaction activities, consolidate relevant information and provide it to respective departments on time. The concerned staff can also analyze customer data and ensure compliance with KYC standards.

Generative AI has the facility to create simulations, predict economic trends and decide on positions in an apt manner. Banks will be able to forecast the inflation rate in the medium term and make appropriate adjustments to the interest rate.

The system has a deep learning model that is capable of analyzing the historical data of a customer, his spending behaviors and risk appetite and then recommend most suited or appropriate products. It is also capable of assessing a customer’s financial history and arriving at his or her credit worthiness. The ML model can be trained to predict possible defaults by evaluating a loan seeker’s earnings, age, occupation, home and similar indicators.

FRAUD DETECTION

One of its crucial uses is in fraud detection. It can identify abnormal patterns in financial transactions and raise alerts, whereby interventions can be made in suspicious transactions.

As Generative AI is based on ML models that can create structured information, it allows banks to automatically generate financial statements on demand. Also, customers can request customized cash flow or income reports, and these can be made available in seconds.

TRAINING SYSTEM CRUCIAL

However, like any AI systems, Generative AI too have certain drawbacks. For example, any deep learning model needs to be trained before being deployed. If the training data is inaccurate, non-relevant or incomplete or even not large enough, there can be devastating results. The training requires storing and moving a large amount of data on the networks and there are regulations in doing so, which might pose restrictions in using certain data. Also, it is the responsibility of the banks to protect the privacy of the customer data.

Though Generative AI is shaping to become a powerful banking tool, banking technology experts, however, advise that banks should never allow Generative AI to take final decisions on issues like loan approvals. It should be used to do the heavy lifting, that is processing data and recommending possible decisions for the financial professionals to choose from.

Nevertheless, Generative AI will transform how banks operate and engage their customers. Banks and their customers will benefit from the efficiency and personalization that it brings when implemented across the institution.

SCALING ML NEEDED

AI experts feel that banks wanting to harness the full potential of Generative AI should create capabilities to scale ML technology across the organization. Banks should also reexamine their technological capabilities and infrastructure to support AI systems and ensure high security in the storage of large amounts of data.

To fully impact the customers, banks have to put in place the right customer engagement strategies. Instead of focusing on specific products, they should reimagine how AI can be roped in to add more value to customers.

Generative AI for sure will change how banks engage customers with personalized and efficient services. It is also poised to save financial institutions substantial costs when implemented smoothly. Whether augmenting customer support with chatbots or detecting fraudulent transactions, it has tremendous roles. Yet, challenges remain, especially in scaling up, particularly in a highly regulated industry like banking.

GENERATIIVE AI: MAJOR RISKS

Gartner, which has tracked the evolution of Generative AI in great detail, lists some of the risks associated with its use: “A wide array of threat actors have already used the technology to create ‘deep fakes’ or copies of products, and generate artifacts to support increasingly complex scams.”

ChatGPT and other tools like it are trained on large amounts of publicly available data. They are not designed to be compliant with General Data Protection Regulation (GDPR) and other copyright laws, so it’s imperative to pay close attention to your enterprises’ uses of the platforms.

Oversight risks to monitor include:

Lack of transparency: Generative AI and ChatGPT models are unpredictable, and not even the companies behind them always understand everything about how they work.

Accuracy: Generative AI systems sometimes produce inaccurate and fabricated answers. Assess all outputs for accuracy, appropriateness and actual usefulness before relying on or publicly distributing information.

Bias: You need policies or controls in place to detect biased outputs and deal with them in a manner consistent with company policy and any relevant legal requirements.

IP & Copyright: There are currently no verifiable data governance and protection assurances regarding confidential enterprise information. Users should assume that any data or queries they enter into the ChatGPT and its competitors will become public information, and we advise enterprises to put in place controls to avoid inadvertently exposing IP.

Cybersecurity & Fraud: Enterprises must prepare for malicious actors’ use of generative AI systems for cyber and fraud attacks, such as those that use deep fakes for social engineering of personnel, and ensure mitigating controls are put in place. Confer with your cyber-insurance provider to verify the degree to which your existing policy covers AI-related breaches.

Sustainability: Generative AI uses significant amounts of electricity. Choose vendors that reduce power consumption and leverage high-quality renewable energy to mitigate the impact on your sustainability goals.