In an effort to curb the rise of digital financial fraud, the Reserve Bank of India (RBI) has unveiled a groundbreaking AI/ML-based model called MuleHunter.ai. […]

Tag: RBI

Revolut India Gears Up for Domestic Expansion with RBI’s PPI License Grant

Financial technology innovator Revolut India has secured a significant milestone in its journey towards becoming a leading digital financial services provider in the Indian market. […]

India and Nepal Join Hands: Faster, Cheaper Cross-Border Remittances via UPI-NPI Linkage

The Reserve Bank of India (RBI) and Nepal Rastra Bank announced a significant collaboration on Thursday, paving the way for seamless cross-border remittances between the […]

RBI Expands Use Cases for CBDC, Introduces Offline Functionality

In a significant move aimed at enhancing financial inclusion, the Reserve Bank of India (RBI) Governor, Shaktikanta Das, announced the expansion of the Central Bank […]

RBI Proposes Framework for Self-Regulatory Organizations in FinTech Sector

The Reserve Bank of India (RBI) has introduced a draft framework for the recognition of Self-Regulatory Organizations (SROs) in the FinTech sector, aiming […]

RBI Urges Strengthening of Financial Institutions Amid Evolving Risks

The Reserve Bank of India (RBI) recently released its “Trend and Progress of Banking in India 2022-23” report, highlighting the need for financial institutions, including […]

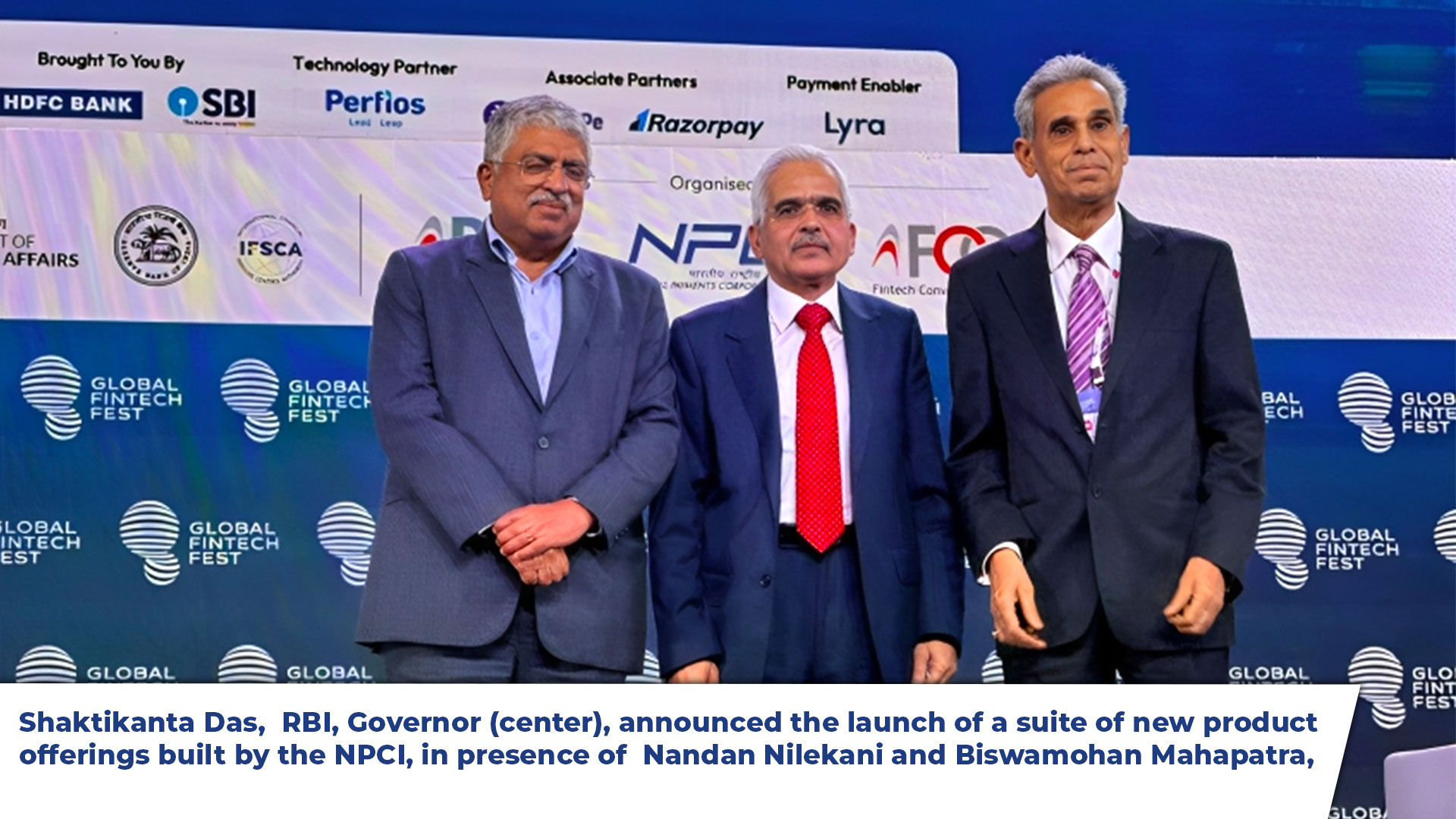

Digital Payment Evolution: RBI Introduces Innovative Payment Solutions

Mumbai, 6th September 2023, in a remarkable stride towards fortifying India’s digital payments landscape, the Reserve Bank of India (RBI), under the guidance of Governor […]

Revamping UPI: A New Dawn in India’s Digital Payments

India’s premier digital payment system, UPI, is set to undergo a significant transformation. Topping the list of novel introductions is “Conversational Payments,” an innovative method […]

Mastercard enables CVC-less payments for tokenized cards in India

Mastercard has introduced Cardholder Verification Code (CVC)-less online transactions for its debit and credit cardholders who have tokenized their cards on merchant platforms. The move […]