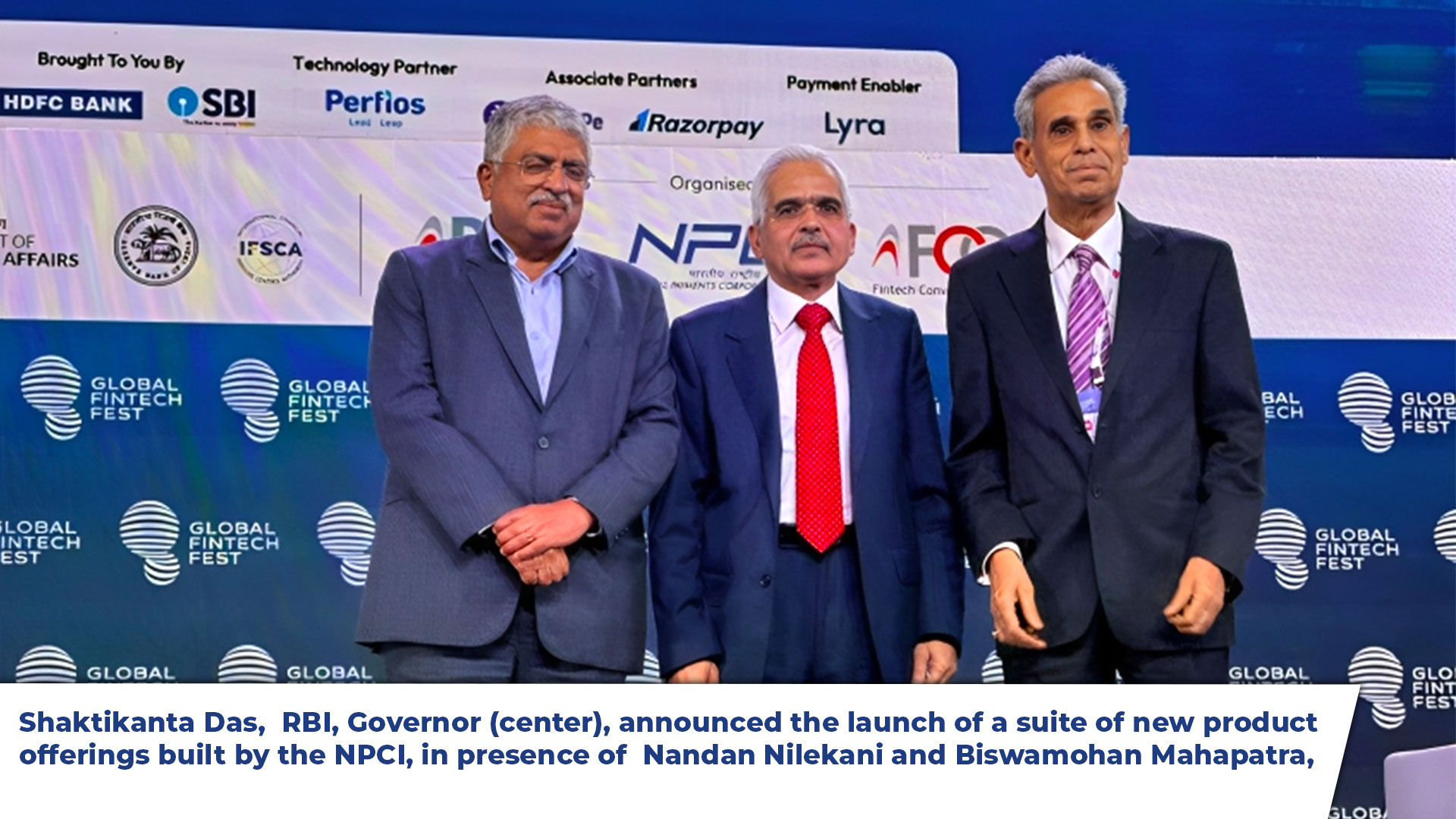

Mumbai, 6th September 2023, in a remarkable stride towards fortifying India’s digital payments landscape, the Reserve Bank of India (RBI), under the guidance of Governor Shri Shaktikanta Das, unveiled a series of avant-garde products at the Global Fintech Fest 2023. The National Payments Corporation of India (NPCI), with insights from industry stalwarts like Shri Nandan Nilekani of Infosys and Shri Biswamohan Mahapatra of NPCI, spearheaded this transformation.

Mumbai, 6th September 2023, in a remarkable stride towards fortifying India’s digital payments landscape, the Reserve Bank of India (RBI), under the guidance of Governor Shri Shaktikanta Das, unveiled a series of avant-garde products at the Global Fintech Fest 2023. The National Payments Corporation of India (NPCI), with insights from industry stalwarts like Shri Nandan Nilekani of Infosys and Shri Biswamohan Mahapatra of NPCI, spearheaded this transformation.

Breaking Barriers with Credit Line on UPI

Aiming to invigorate financial inclusion and innovation, RBI has pioneered the concept of Credit Line on UPI. This groundbreaking mechanism will enhance customers’ accessibility to credit in the digital age. By intertwining pre-sanctioned credit lines with UPI, the complexities of availing and utilizing credit are set to diminish. A confluence of features like digital credit product formulations, scheduled charge structures, interest-free durations, and an expansive UPI app ecosystem promises a swift, integrated banking experience.

UPI LITE X and Tap & Pay – Bridging Connectivity Gaps

Expanding on the triumph of UPI LITE, the newly minted UPI LITE X facilitates offline transactions, ensuring no resident is left behind due to connectivity issues. Whether you’re in a subway or a secluded area, NFC-compatible devices are all you need to transact smoothly.

Furthermore, the introduction of UPI Tap & Pay amalgamates the QR code’s efficacy with NFC technology. Gone are the days of just scanning; now, users can complete payments by merely tapping NFC-integrated QR codes.

The Future is Conversational

Digital payments in India are about to get more interactive. Conversational Payments, driven by AI, are anticipated to redefine human-machine engagements.

Hello! UPI: A commendable step towards linguistic inclusivity, this conversational tool enables users to make voice-commanded UPI payments. Whether via UPI apps, phone calls, or IoT gadgets, transactions can now resonate in Hindi and English. Moreover, other regional languages are soon to follow. This initiative, forged in collaboration with the Bhashini program at IIT Madras, is poised to resonate with the masses, especially those who prioritize their regional tongue.

BillPay Connect: Revolutionizing bill payments, this platform integrates a nationalized contact point for bill settlements across India. Whether you’re texting a simple greeting on a messaging app or giving a missed call, bills can be fetched and paid with unprecedented ease. This service further embellishes its offerings with voice-commanded bill payments and auditory confirmations, amplifying user trust and convenience.

In summation, these novel introductions by the RBI, in collaboration with NPCI, affirm India’s commitment to a holistic, resilient, and inclusive digital payment future.