BMO Global Asset Management (BMO GAM) has launched BMO Georgian Alignment II Access Fund LP (Access Fund), which offers an opportunity for Canadian accredited investors to gain exposure to privately-held companies, a part of the real economy traditionally reserved for institutional investors.

Tag: payments

Xpansiv Completes Acquisition of Evolution Markets

Xpansiv, an infrastructure provider for environmental markets, has completed its acquisition of Evolution Markets Inc., a provider of transaction and advisory services in the global carbon, renewable energy, and energy transition markets. The merger of the two companies will expand Xpansiv’s service offerings and product development capabilities to help empower the energy transition.

Singapore’s Monetary Authority to Foster Talent Pool for Financial Institutions

The Monetary Authority of Singapore (MAS) and the Institute of Banking & Finance (IBF) will continue to work with financial institutions (FIs) and tripartite partners to develop and grow the local talent pool to meet the financial sector’s needs, including that of Single Family Offices (SFOs), said Tharman Shanmugaratnam, Senior Minister and Minister in charge of MAS.

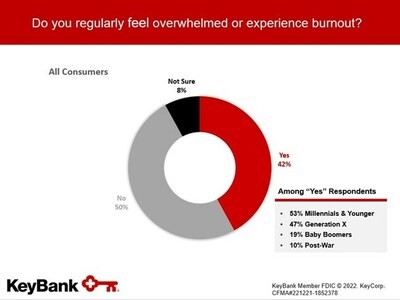

Burnout Hitting Younger Americans Amid Demand for Digital Products, Guidance

The KeyBank 2023 Financial Mobility Survey, released on Monday, finds that Americans are in a difficult financial situation, with 55% facing financial challenges in the last year, a significant increase from the previous year (37%), and more than double the number of respondents citing budgeting issues as their biggest financial faux pas (89% vs. 35%, respectively). Yet, even as Americans face these challenges, the majority (85%) strongly desire to become more aware of their financial picture.

Abu Dhabi Islamic Bank’s Customers Can Now Use Wearables To Make Payments

Abu Dhabi Islamic Bank (ADIB) recently launched the region’s first tokenised, contactless payment methods through the options of clasp and ring ‘ADIB PAY’, in partnership with token enablement service provider Tappy Technologies and global digital payments leader, Visa.

ADB, India Sign $350mn Loan To Improve Connectivity in Maharashtra

The Asian Development Bank (ADB) and the Government of India have signed a $350 million loan to improve the connectivity of key economic areas in Maharashtra. At least 319 kms of state highways and 149 kms of roads in the 10 districts will be upgraded as part of the agreement.

Bank of Russia Continues Measures to Support National Payment System Entities

The Bank of Russia implemented measures to support National Payment System (NPS) entities in 2022. They were approved in response to changes in the conditions of money transfers in the midst of restrictions imposed by foreign states, and they helped in the timely reduction of the burden on NPS entities. These measures will expire on January 1, 2023.

Fed To Revise Payment System Risk policy

The Board of Governors of the Federal Reserve System (Board) is revising part II of the Federal Reserve Policy on Payment System Risk (PSR policy) to add a posting rule to facilitate the implementation of enhancements to the Automated Claim Adjustment Process (ACAP).

Re-Thinking Cross Border Payment Infrastructure | FinTech Frontiers Live

An in-depth discussion with Mike Robertson, CEO, and Co-Founder of AbbeyCross, Adrian Brown, COO and Co-Founder of AbbeyCross, Babu Nair, MD and CEO of Banking Frontiers & Financial Technology Frontiers dives deeper into the areas of weakness in the global payment infrastructure and how banks are bringing in efficiency while managing the costs.

They also discussed the existing infrastructure models within banks’ processes, as well as the key technology drivers.

Furthermore, they discussed their experiences with vendors and bank engagement channels, as well as the importance of data documentation prior to vendor onboarding.

From Output To Outcomes Interview with Paolo Sironi | FinTech Frontiers Live

Paolo Sironi, Global Research Leader in Banking and Financial Markets, IBM Consulting, explains how organizations have been transforming from output to outcome-based economies. He shares how achieving one’s financial, personal, and professional goals is a valuable asset and the role of value insight creation in enabling contextual and conscious banking. He talks about how enriching customer insights can have enhanced value due to digital transparency and trust-based technology. He throws light on how an ecosystem of open transparency fosters stronger technological ties while deliberating the potential of banks and fintech to enable and unlock better values.