In an era of evolving banking landscapes, Assisted Self-Service Terminals (ASSTs) have emerged as key players in the transformation of traditional banking models. The surge in installations, both inside and outside branches globally, reflects a double-digit growth trend, showcasing their pivotal role in redefining customer interactions and optimizing banking networks.

The Global Branch Transformation 2024 study, conducted by RBR Data Services, a division of Datos Insights, unveils a significant decline in the number of bank branches worldwide. Financial institutions are strategically streamlining operations, aiming to achieve more with fewer physical outlets. The study highlights the expanding role of bank tellers, who are increasingly expected to focus on sales and advisory activities rather than routine transactions.

Teller Assist Units (TAUs) have played a crucial role in automating cash operations at the teller counter, addressing challenges around branch profitability. However, the focus is shifting towards migrating transactions to self-service channels, with ASSTs serving as a key facilitator in this transition.

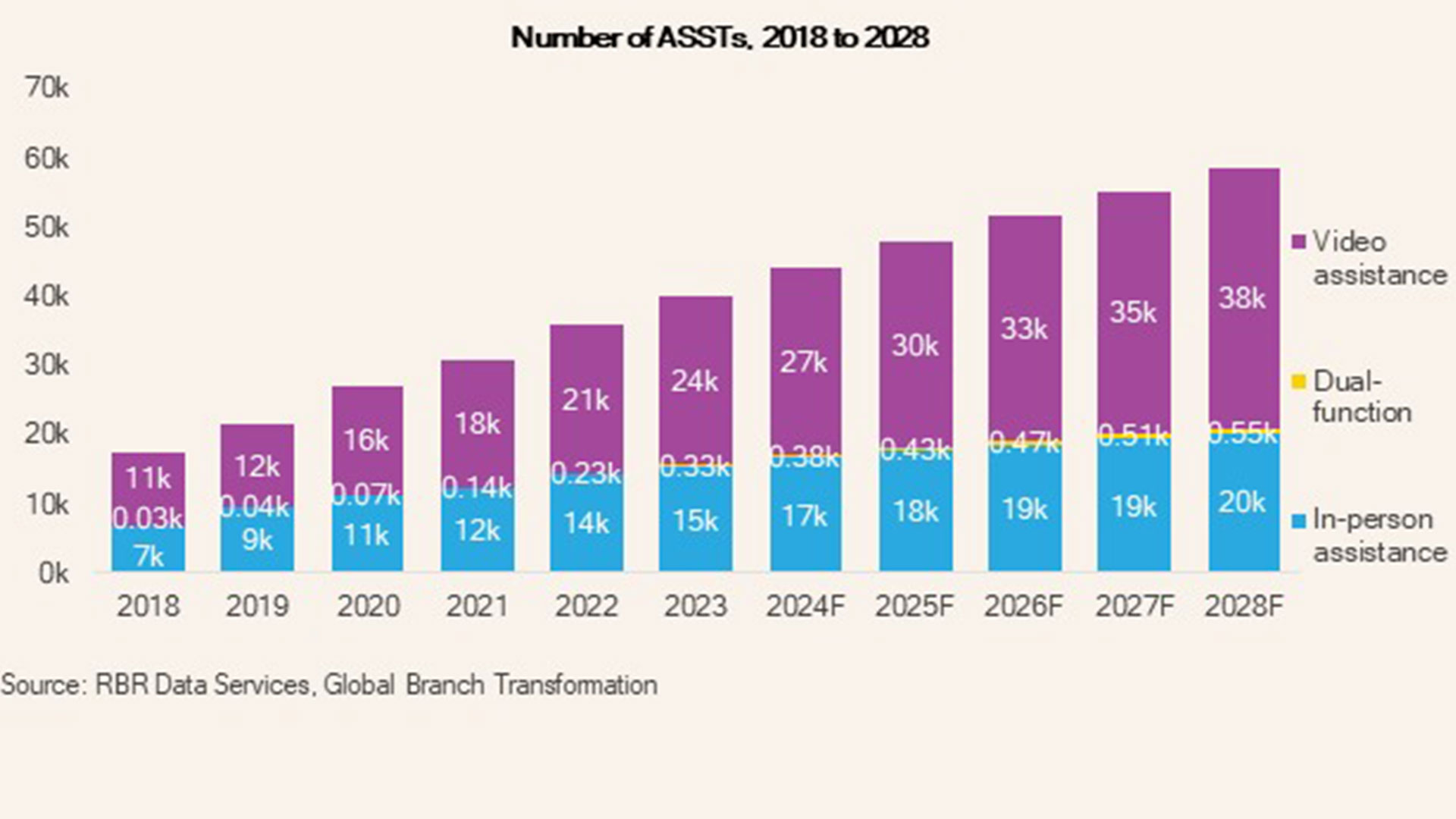

The RBR Data Services study indicates a 12% growth in ASST installations in 2023, underlining the accelerating shift of transactions away from traditional teller lines. These terminals empower customers to request assistance, either in-person from branch staff or remotely via video links, for more complex transactions, fostering confidence in self-service banking.

With nearly 40,000 ASSTs installed across 20 key markets, the USA leads in adoption, accounting for well over two-thirds of these terminals. The global reach of ASSTs is expanding, with notable introductions in Germany in 2021 and South Africa in 2023, signalling a global recognition of their transformative potential.

Globally, over 60% of ASSTs are video devices, predominantly deployed in the USA to extend service hours and geographic access. In contrast, in-person devices are more prevalent in Italy and Turkey, emphasizing cost-effectiveness and the retention of face-to-face banking interactions. Smaller banks and credit unions favor video installations, aligning with their business models.

Forecasts indicate a continued surge in ASST installations, with an estimated 58,700 terminals expected in bank branches worldwide by 2028. While the USA remains a dominant market for remote devices, the diverse functionalities of in-person and dual-function technology cater to specific institutional requirements, supporting the ongoing trend of branch optimization.

Despite global enthusiasm, three markets – France, Mexico, and Poland – have yet to adopt ASSTs due to concerns about costs and customer acceptance. However, the study suggests that France is likely to embrace ASSTs by 2028, highlighting the growing recognition of their unique benefits in shaping modern branch formats.

Gillian Shaw, leader of RBR Data Services’ Global Branch Transformation 2024 research, affirms, “The unique benefits of ASSTs in enabling more modern branch formats are being recognized globally. With branch optimization remaining a key priority, the penetration of ASSTs is expected to grow, offering financial institutions versatile solutions tailored to their specific requirements.”

Read more: https://fintechfrontiers.live/ai-is-strengthening-processes-in-insurance/