The UK’s Financial Conduct Authority (FCA) has unveiled a proposal to allow banks, pension firms, and other financial providers to offer simplified, potentially free financial advice to millions of consumers with low to moderate asset levels. This move is part of a broader effort to bridge the “advice gap” that prevents middle-income and lower-wealth individuals from receiving appropriate financial guidance. This proposal is under consultation with a final framework expected within the next 6–12 months. Through this change, the FCA wants to see a thriving and trusted market for full financial advice, simplified advice, targeted support and guidance. The FCA’s proposal could transform UK’s financial advice landscape by democratizing the access to guidance, much like open banking does for payments. It positions the FCA as UK’s regulatory innovator, and if successful, this could inspire North American regulators to follow suit, making this a crucial trend for financial institutions and fintech developers to monitor.

The UK’s Financial Conduct Authority (FCA) has unveiled a proposal to allow banks, pension firms, and other financial providers to offer simplified, potentially free financial advice to millions of consumers with low to moderate asset levels. This move is part of a broader effort to bridge the “advice gap” that prevents middle-income and lower-wealth individuals from receiving appropriate financial guidance. This proposal is under consultation with a final framework expected within the next 6–12 months. Through this change, the FCA wants to see a thriving and trusted market for full financial advice, simplified advice, targeted support and guidance. The FCA’s proposal could transform UK’s financial advice landscape by democratizing the access to guidance, much like open banking does for payments. It positions the FCA as UK’s regulatory innovator, and if successful, this could inspire North American regulators to follow suit, making this a crucial trend for financial institutions and fintech developers to monitor.

Sarah Pritchard, deputy chief executive of the FCA, said:

‘We want to help consumers navigate their financial lives and plan for the long term. Some of the most difficult financial decisions we face are how to save, invest and prepare for a comfortable retirement. These once-in-a-generation reforms will help people navigate their financial lives and give them greater confidence to invest. This is a win-win for consumers and firms alike.’

Chancellor of the Exchequer, Rachel Reeves, said:

‘Too many people are missing out on the support they need to build a more secure financial future for themselves and their families. Today’s reforms will make a real difference to help working people make better long-term financial decisions, ultimately putting more money in their pockets as part of our Plan for Change.’

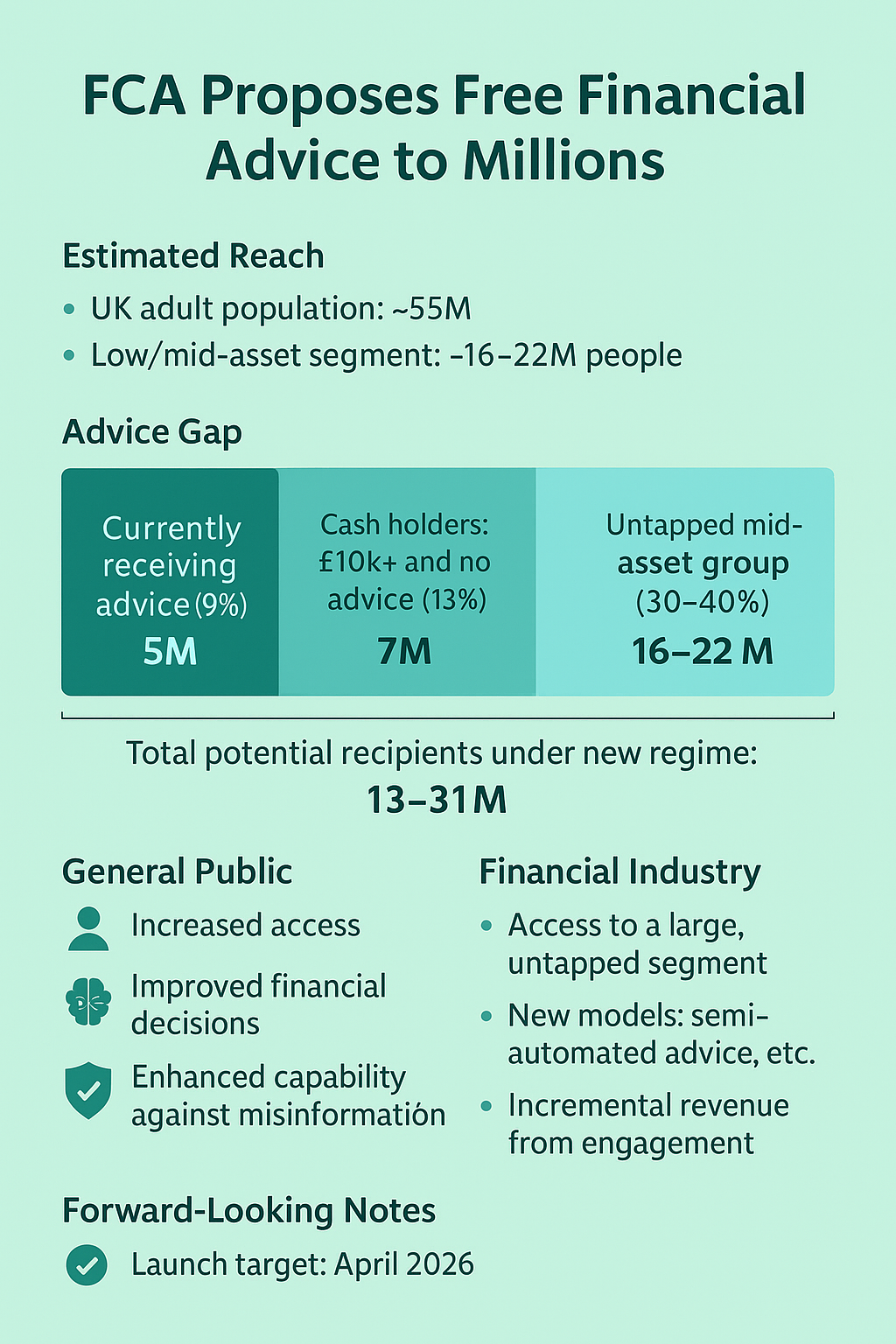

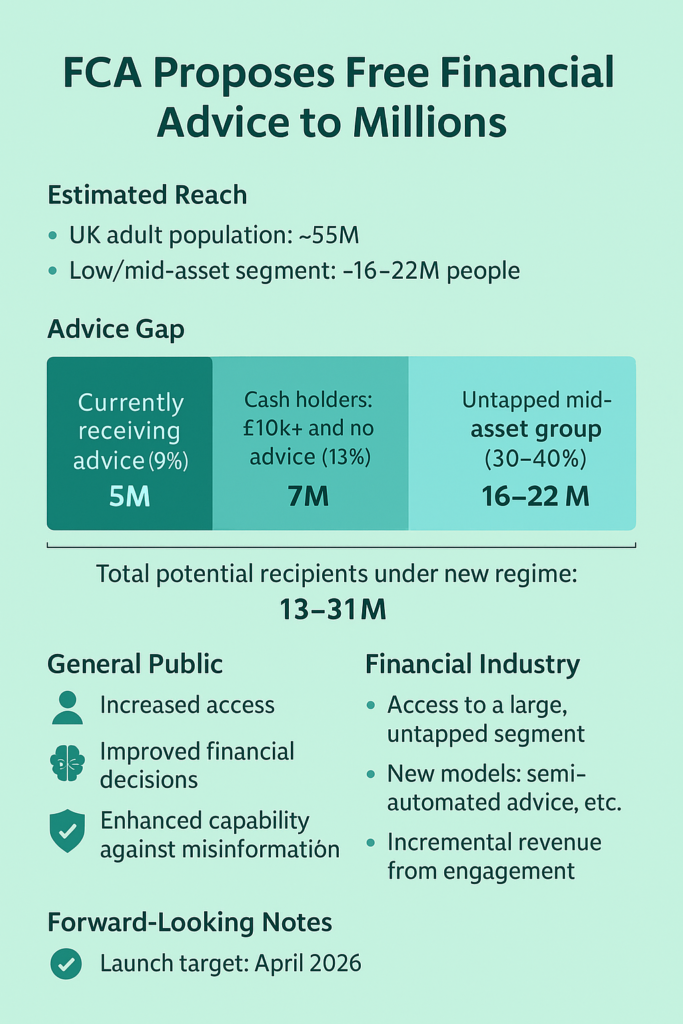

Historically, advice from financial institutions has been skewed towards affluent clients due to high compliance costs and complex regulatory frameworks. According to the FCA, only 9 % of UK adults received regulated financial advice last year, about their pensions or investments. The FCA now seeks to loosen restrictions to make financial help more accessible and affordable. Select statistics from FCA include:

- 6% of adults had no current account (2.1% in 2022)

- 14% had no general insurance or protection products (14% in 2022)

- 13% were off ered a general insurance or protection policy in the last 2 years at a price, or with terms and conditions, they felt to be completely unreasonable (6% in 2022), while 5% were put off applying for a policy, because they thought they would not be eligible or would not be able to afford the policy (3% in 2022)

- 22% of those who applied for a regulated credit product in the last 2 years were declined (24% in 2022)

- 4% held high-cost credit (5.3% in 2022)

- 8% were constantly overdrawn or usually overdrawn by the time they got paid or received their income (8% in 2022)

- 6% said they had borrowed from an unlicensed moneylender/another informal lender (ie an illegal moneylender) in the previous 12 months (0.5% in 2022)

Here are some key benefits:

In the UK, approximately 30–40% of the adult population (16 to 21 million people) fall into the low-to-mid asset group, who could benefit from this proposed change. This will enable them to have easier access to investment guidance, allow them to make better-informed financial decisions about pensions, savings, and debt, and reduce their financial vulnerability due to bad or no advice from financial institutions.

For UK financial institutions, this provides an avenue to pursue new client segments that were previously deemed unviable. They could launch new products and services using more scalable advice models such as those leveraging robo-advisors or semi-automated platforms, and enhance customer relationships through bundling value-added services. Pilot programs may roll out through major banks or pension providers.

The Result:

- Enables broader financial inclusion by reducing systemic bias in financial services toward wealthy clientele.

- Drives market innovation through promoting the use of hybrid digital-human advisory models, fostering fintech partnerships.

- Fosters economic stability for individuals through a better informed consumer behavior, and reducing long-term reliance on state support and increase household wealth resilience.

The Shaping of the Future Financial Advisory:

This proposal is expected to change UK’s financial advisory space. Notably, banks and fiintech companies are likely to take advantage of this opportunity to generate new tools and processes to meet the needs of client segments hitherto not approached. And the 9% adult financial advise coverage could grow to a potential 50% reach.

About This Article

This article is compiled by Financial Technology Frontiers, based on its industry research supported by FCA’s publications. Written in an accessible format, this article’s aim is to raise awareness about developments in the financial services industry, globally. FTF desires that both financial service providers and technology companies take benefit from this article and ponder over their respective programs to support this change.

About Financial Technology Frontiers

Financial Technology Frontiers (FTF) is a global media-led fintech platform dedicated to building and nurturing innovation ecosystems. We bring together thought leaders, financial institutions, fintech disruptors, and technology pioneers to drive meaningful change in the financial services industry.