The European Central Bank (ECB) released the findings of the December 2023 Survey on credit terms and conditions in euro-denominated securities financing and over-the-counter derivatives markets (SESFOD). The survey offers insights into the evolving landscape of credit terms, market-making activities, and expectations across the financial sector.

Credit Terms and Conditions Trends

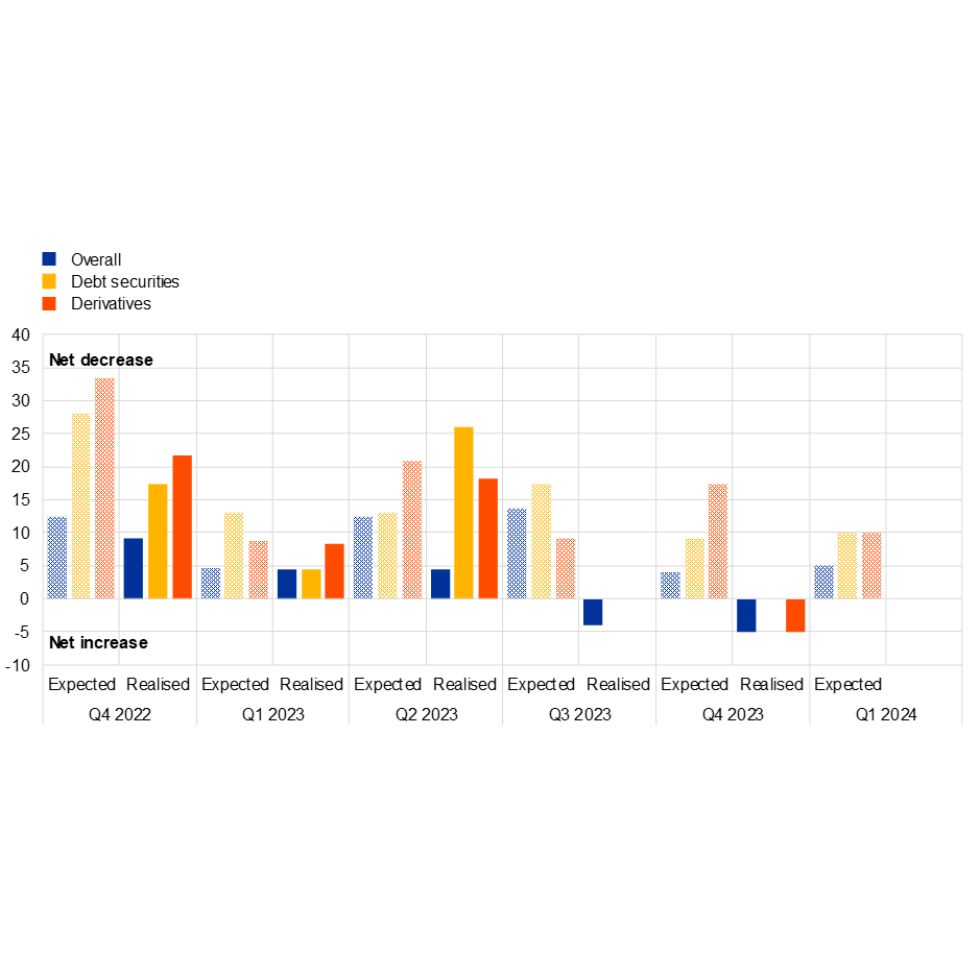

Between September and November 2023, overall credit terms and conditions remained relatively stable, contrary to expectations of tightening expressed in the previous survey. However, respondents anticipate a tightening of credit terms over the period from December 2023 to February 2024.

Chart 1 –

Realised and expected quarterly changes in overall credit terms and price/non-price terms offered to counterparties across all transaction types

Key Findings

– Financing rates and the maximum maturity of funding have increased.

– Market-making activities have surged over the past year, particularly for domestic government bonds and high-quality non-financial corporate bonds.

– Use of central counterparties (CCPs) for securities financing transactions has seen a notable increase.

– Overall demand for funding has risen, with liquidity and functioning of collateral markets showing signs of deterioration.

– Initial margin requirements for non-centrally cleared over-the-counter (OTC) derivatives have slightly increased for most derivative types.

Market-Making Activities

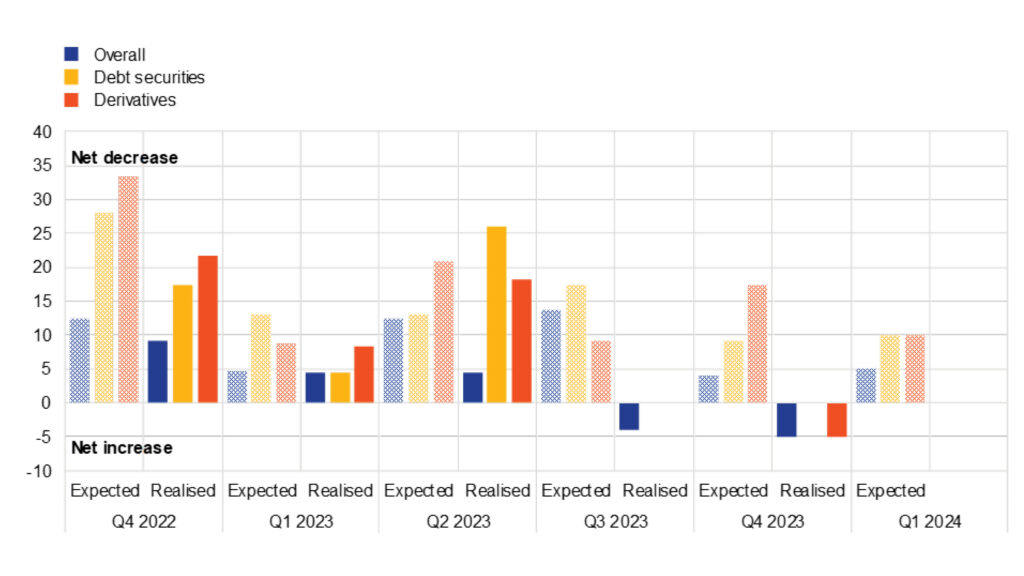

Respondents reported an increase in market-making activities over the past year, driven primarily by the willingness of institutions to take on risk. The profitability of market-making activities and the availability of balance sheet or capital were cited as significant factors behind expected increases in market-making activities for the year ahead.

Chart 2 –

Realised and expected annual changes in market-making activities

Confidence in Market-Making Abilities

Survey participants expressed confidence in their ability to act as market-makers in times of stress across all types of debt securities and derivatives. Willingness to take on risk remained the primary reason for banks’ confidence in this regard.

The results of the December 2023 SESFOD survey underscore the dynamic nature of credit terms and market-making activities in the financial sector. With expectations of tightening credit terms and robust market-making activities anticipated for the year ahead, financial institutions are poised to navigate evolving market conditions with resilience and adaptability.

The SESFOD survey, conducted four times a year, provides valuable insights into changes in credit terms and conditions, offering a comprehensive view of market dynamics and trends across the financial landscape.

Note: The December 2023 survey collected qualitative information on changes between September and November 2023, based on responses from a panel of 25 large banks, including 13-euro area banks and 12 banks with head offices outside the euro area.