A Capgemini Research Institute study highlights an unprecedented situation that is facing the life insurance industry:

Life insurers are facing an unprecedented shift with a possible significant outflow of assets under management (AUM), ahead of history’s largest inter-generational wealth transfer.

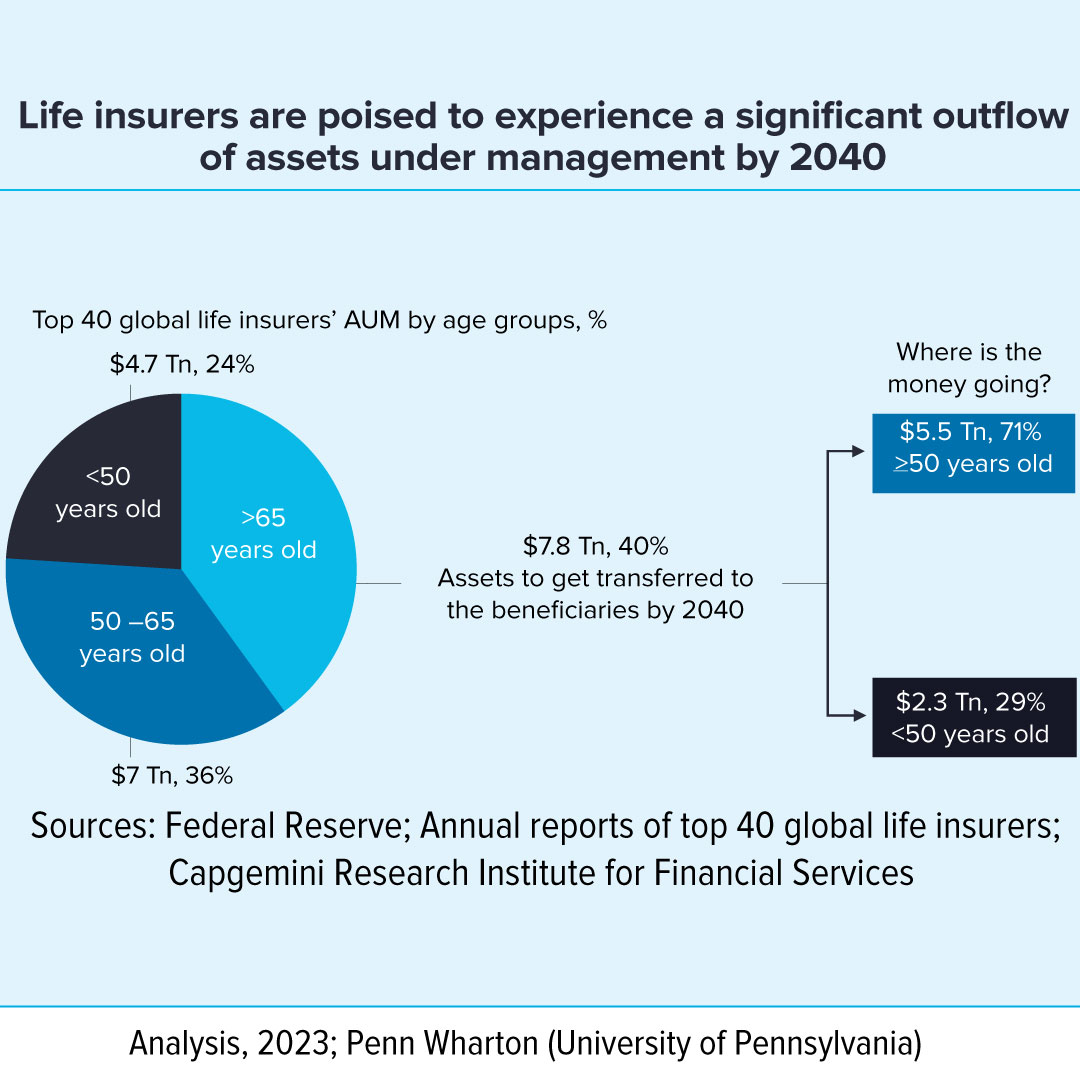

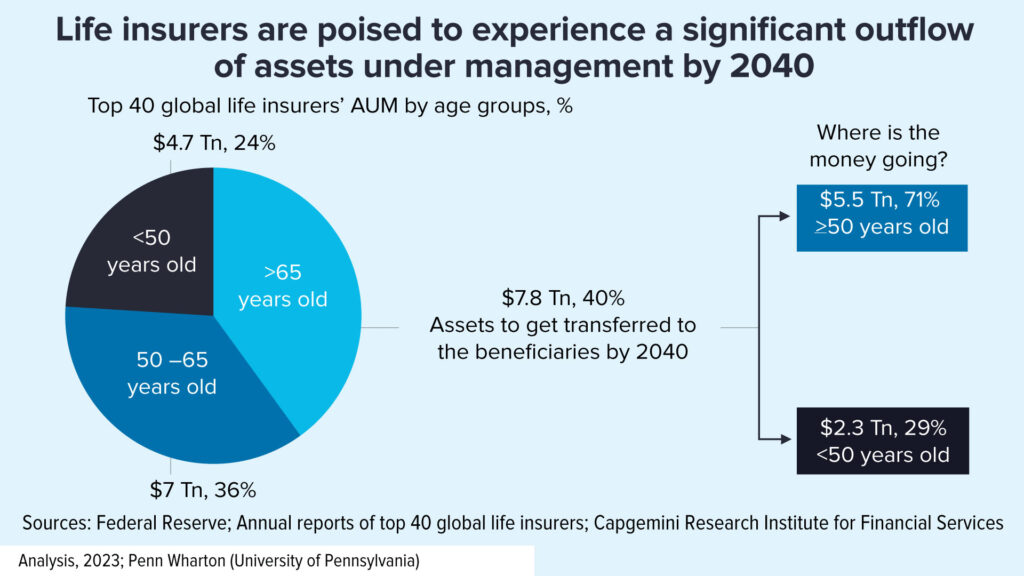

According to a study carried out by the Capgemini Research Institute and titled World Life Insurance Report 2023, currently policyholders over the age of 65 own 40% of insurers’ AUM, which for the 40 largest global life insurers totals US$7.8 trillion. These assets are poised to be transferred to beneficiaries by 2040, states the study.

LACK OF FINANCIAL PLAN

The report recalls the prediction by the UN that 33% of the world’s population will be over the age of 50 by 2050, and highlights that most senior citizens lack a financial plan for aging well. “As much as 60% of individuals aged 65 or older have not sought professional financial advice to prepare for retirement or to transfer their wealth,” states the report.

The report based its findings on 2 primary sources – the 2023 Global Insurance Voice of the Customer Survey and the 2023 Global Insurance Executive Interviews. The research covered insights from 23 markets. The study also included insights from interviews with 200 senior insurance executives of leading insurance companies across 14 markets, which represent the Americas (North America and Latin America), EMEA and APAC.

LACK OF PRODUCTS

The report points out that 3 in 4 consumers are interested in innovative life insurance offerings to help them age well, but insurers lack the product development capabilities.

Many people approaching retirement are being forced to shoulder more of the financial responsibility for aging well as unique economic headwinds, declining governmental support and increasing healthcare costs exacerbate the cost-of-living crisis, cautions the report, adding: “Despite these conditions creating a greater need for life insurance, consumers face growing barriers to product adoption. Policyholders report complexity across life insurance offerings and limited awareness (39%) as the biggest obstacles, followed by a lack of trust (29%).”

STAYING RELEVANT

The report says the biggest challenge life insurers currently face is staying relevant amid the greatest wealth transfer. It recommends prioritizing affluent and mass affluent consumers who hold 39% of global wealth and account for about 20% of the aging population to protect the AUM that are at risk, pointing out that this segment has the greatest need for aging-well solutions, with more than 75% wanting innovative life products. “However, only 27% of insurers have the advanced product development capabilities to provide them,” the study points out

The report also states that more than 44% of 50+ year old affluent and mass affluent customers expect their insurers to provide such services, ranging from wellness initiatives to assisted living. In this scenario, ecosystem partnerships will prove critical for insurers to close this gap by orchestrating a wide universe of value-added services, it adds.

PROTECTING ASSETS

The report highlights the need for insurers to find a path to protect assets and boost growth and points out that it will be a journey that will take insurers from today’s product-centric approach to an operating model focused on customer-centricity, with comprehensive, higher-value solutions designed to help consumers age well.

“This transition requires a value chain evolution aimed at enhancing the customer onboarding process and driving policyholder and beneficiary engagement. Subsequently, beneficiaries can be transformed into new customers and claims effectively converted into opportunities for revenue generation,” the report emphasizes.

In this exercise, the report states that insurers can consolidate data for a single view of the customer and digitally empower agents by leveraging AI, including generative AI, to offer hyper-personalized advice. “However, only 21% of insurers have the tools for advanced data analytics capabilities, and 19% are taking advantage of advanced technologies to streamline operations, enrich experiences, integrate across emerging ecosystems, and make faster and more data-driven decisions,” it cautions.

The report recommends that insurers can drive policyholder and beneficiary engagement to deepen customer relationships by simplifying and personalizing the onboarding journey; elevate the claims experience by providing flexibility in claims restructuring; and capture a single view of the customer by modernizing their technology layer.

Read more: https://fintechfrontiers.live/ransomware-detection-declines-apt-activity-rises/