Xpansiv, an infrastructure provider for environmental markets, has completed its acquisition of Evolution Markets Inc., a provider of transaction and advisory services in the global carbon, renewable energy, and energy transition markets. The merger of the two companies will expand Xpansiv’s service offerings and product development capabilities to help empower the energy transition.

Author: Editorial Team

Singapore’s Monetary Authority to Foster Talent Pool for Financial Institutions

The Monetary Authority of Singapore (MAS) and the Institute of Banking & Finance (IBF) will continue to work with financial institutions (FIs) and tripartite partners to develop and grow the local talent pool to meet the financial sector’s needs, including that of Single Family Offices (SFOs), said Tharman Shanmugaratnam, Senior Minister and Minister in charge of MAS.

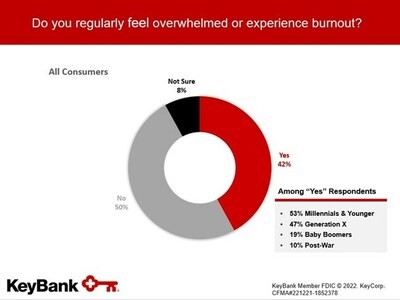

Burnout Hitting Younger Americans Amid Demand for Digital Products, Guidance

The KeyBank 2023 Financial Mobility Survey, released on Monday, finds that Americans are in a difficult financial situation, with 55% facing financial challenges in the last year, a significant increase from the previous year (37%), and more than double the number of respondents citing budgeting issues as their biggest financial faux pas (89% vs. 35%, respectively). Yet, even as Americans face these challenges, the majority (85%) strongly desire to become more aware of their financial picture.

Abu Dhabi Islamic Bank’s Customers Can Now Use Wearables To Make Payments

Abu Dhabi Islamic Bank (ADIB) recently launched the region’s first tokenised, contactless payment methods through the options of clasp and ring ‘ADIB PAY’, in partnership with token enablement service provider Tappy Technologies and global digital payments leader, Visa.

Fintechs Fail When Not Understanding Customers

Emirates NBD, Dubai’s government-owned bank and one of the largest banking groups in the Middle East in terms of assets, is considered as a pioneer in adopting disruptive technologies designed to transform banking operations and to offer extreme customer delight. The bank has an embedded culture to continually innovate and move to newer levels. It has made significant investments in new technologies so that its technology infrastructure is state-of-the-art and it could make major breakthroughs in digitization.

ADB, India Sign $350mn Loan To Improve Connectivity in Maharashtra

The Asian Development Bank (ADB) and the Government of India have signed a $350 million loan to improve the connectivity of key economic areas in Maharashtra. At least 319 kms of state highways and 149 kms of roads in the 10 districts will be upgraded as part of the agreement.

World Bank Chief Warns of Multi-Year Slow Growth

During his opening remarks at the launch of the International Debt Report 2022, the World Bank Group President said, “We identified the stagflation risk early in the year. The deterioration is continuing. This brings three risks: a global recession in 2023; a multi-year period of slow growth; and widespread asset repricing as higher interest rates are applied, and hedges run out. Many of the impacts will be delayed even into 2024 and 2025 including debt restructurings.”

Bank of Russia Continues Measures to Support National Payment System Entities

The Bank of Russia implemented measures to support National Payment System (NPS) entities in 2022. They were approved in response to changes in the conditions of money transfers in the midst of restrictions imposed by foreign states, and they helped in the timely reduction of the burden on NPS entities. These measures will expire on January 1, 2023.

Evolving Tech Risk & GRC Frameworks by Narasimham Nittala | FinTech Frontiers Live

Evolving Tech Risk & GRC Frameworks by Narasimham Nittala | Fintech Frontiers Live

Fed To Revise Payment System Risk policy

The Board of Governors of the Federal Reserve System (Board) is revising part II of the Federal Reserve Policy on Payment System Risk (PSR policy) to add a posting rule to facilitate the implementation of enhancements to the Automated Claim Adjustment Process (ACAP).