Canadian Tire Bank, the financial services arm of Toronto-based retail chain Canadian Tire, is a specialized institution that offers credit cards. It has some 11 million active members of Triangle Rewards, a rewards scheme of the bank. The bank, nevertheless, offers savings and investment products as well as credit card insurance products.

Canadian Tire Bank, the financial services arm of Toronto-based retail chain Canadian Tire, is a specialized institution that offers credit cards. It has some 11 million active members of Triangle Rewards, a rewards scheme of the bank. The bank, nevertheless, offers savings and investment products as well as credit card insurance products.

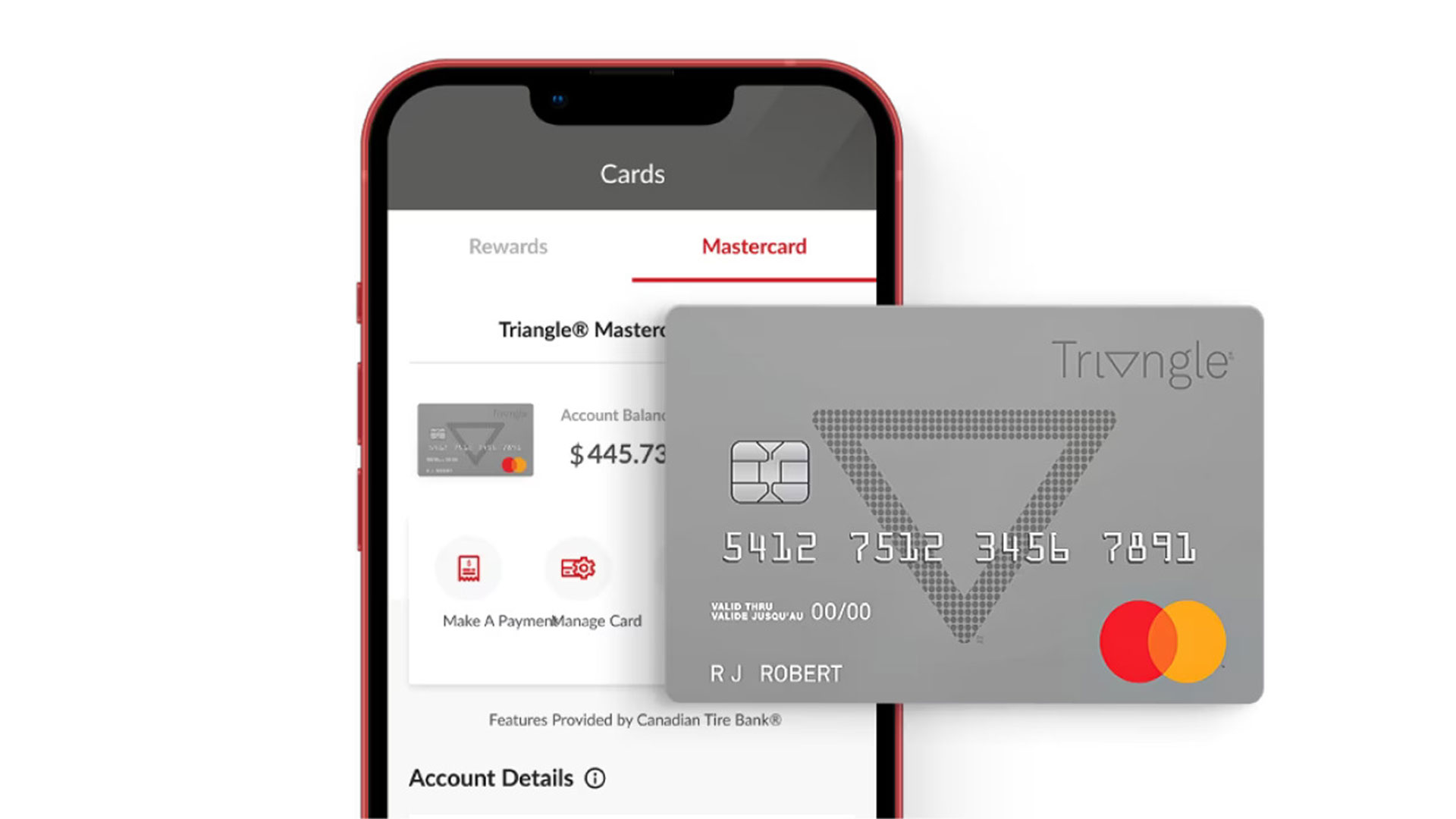

Set up in 2003, the bank does not have any physical branches. Customers have to use online banking or its Triangle app. The app and the online banking system allow a customer to view transactions, account balance, credit card statement and pay bills. Customers can also avail text messages or email alerts services. All the other operations are through these 2 channels only.

UNIQUE BANKING SERVICES

The bank’s Canadian Tire High Interest Savings Account has no monthly fees and no minimum balance requirement, and it offers an annual interest rate is 3%. Canadian Tire Tax Free High Interest Savings Account too has no monthly fees and no minimum balance requirement. It also has an annual interest rate of 3%. It also has 4 credit cards on offer – Triangle Mastercard, Triangle World Elite Mastercard, Gas Advantage Mastercard and Cash Advantage Mastercard. In addition to the accounts and cards, there are 2 credit card insurance products that helps a customer with payments on Canadian Tire Bank–issued credit card in case of need. The bank, however, does not offer chequing accounts or in-person banking.

In fact, the advantages of having a Canadian Tire Bank account are that there is freedom to bank anytime, anywhere with online banking, regular interest rates on HISA, TFSA, and GIC investments, no monthly fees and lower bank fees than most traditional banks and higher credit card rewards and offers for shopping at Canadian Tire stores. On the flip side, the bank does not have any physical branches, therefore no in-person service, no chequing accounts to facilitate day-to-day banking and no provision to redeem credit card rewards outside the participating store network.

TRIANGLE CREDIT CARDS

The Triangle credit cards are accepted at more than 24 million locations worldwide and offers its customers the ability to collect Canadian Tire Money a faster way. The bank has the Triangle Mastercard, Triangle World Mastercard and Triangle World Elite Mastercard, in addition to Gas Advantage Mastercard and Cash Advantage Mastercard.

The bank believes in keeping ‘Customers for Life’. This is being done by using the latest in technology with a strong values system. It has reinforced that its business is built on 4 key strategies:

- Knowledge and understanding of the customers and their needs

- Timely development of new services to meet these needs

- Matching the right customer with the right service at the right time

- Providing service, quality, and value that keep ‘Customers for Life’.

TEMENOS SYSTEM FOR DIGITAL

The bank has Temenos open platform that has replaced its legacy systems and helped it introduce new digital-only offerings. Temenos has also helped it in its growth by delivering faster to the market and richer digital experiences, boosting customer engagement, and bottom-line revenue. One of the key aims of having the new Temenos platform is to improve the digital banking capabilities and better integration across Canadian Tire Corporation’s retail brands and 11 million active loyalty members. It is also now planning to introduce ‘buy now, pay later’ (BNPL) products.

The bank has also adopted Temenos Banking Cloud to accelerate its core banking modernization. Offered as a SaaS model, it helps the bank introduce new business models and enables it to deploy services more easily.

TO KNOW THE WHY

The bank has recently partnered with Quantum Metric, a firm that offers a platform to have a structured approach to understanding the digital customer journey, mainly to understand the ‘why’ behind customer frustrations and the extent of the frustrations that impact customer experience. This has drastically reduced the time needed to identify and resolve issues and minimized escalations across the organization. For instance, the bank experienced an increase in drop-offs in credit card enrolment and using Quantum Metric, it could realize that when the site could not verify a customer’s ID, it would ask them to visit a physical location, leading many to give up on the process altogether. The bank could then integrate new services like SecureKey and Verify.Me, which has enabled it to enhance credit card acquisition throughput, resulting in a 40% increase in successful credit card apps.

The bank’s parent group Canadian Tire Corporation has recently announced a $3.4 billion investment over 4 years to improve omnichannel customer experience for the entire group’s customers. The plan specifically includes expanding Triangle Rewards to drive customer engagement and fuel growth across banners and strengthening data-led personalized marketing capabilities with a world-class partnership network. Besides, it is also envisaged to have a national rollout of Triangle Select, a new premium annual fee-based membership program – to deliver an enhanced value proposition across CTC banners.