Smart TPRM is a more dynamic, risk-intelligent, and technology-enabled evolution of TPRM. It is a risk-centric, lifecycle-driven approach to managing relationships with external providers—especially those handling tech, data, cloud, and cybersecurity services. The salient differentiators vis-a-vis traditional TPRM lie in several dimensions of the practice and their influence on tech risk includes.

- Risk identification & classification: Not all vendors pose equal risk. For example, cloud providers or core application suppliers demand more scrutiny than office consumables’ supply vendors.

- Continuous monitoring: Smart TPRM tracks vendor performance, cyber hygiene, concentration risk, SLA compliance, and privacy practices on a continuous basis as against the traditional “point-in-in-time”.

- Incident preparedness: Smart TPRM is more stringent on responsibility and accountability factors and ensures vendors play by agreed-upon incident response and reporting protocols, integrated into the Company’s overall incident management / resilience plan.

This Smart TPRM model goes beyond basic procurement and vendor management practices. It embeds governance, security, and operational continuity into vendor relationships and their service delivery. This is critical when key functions or sensitive systems are outsourced.

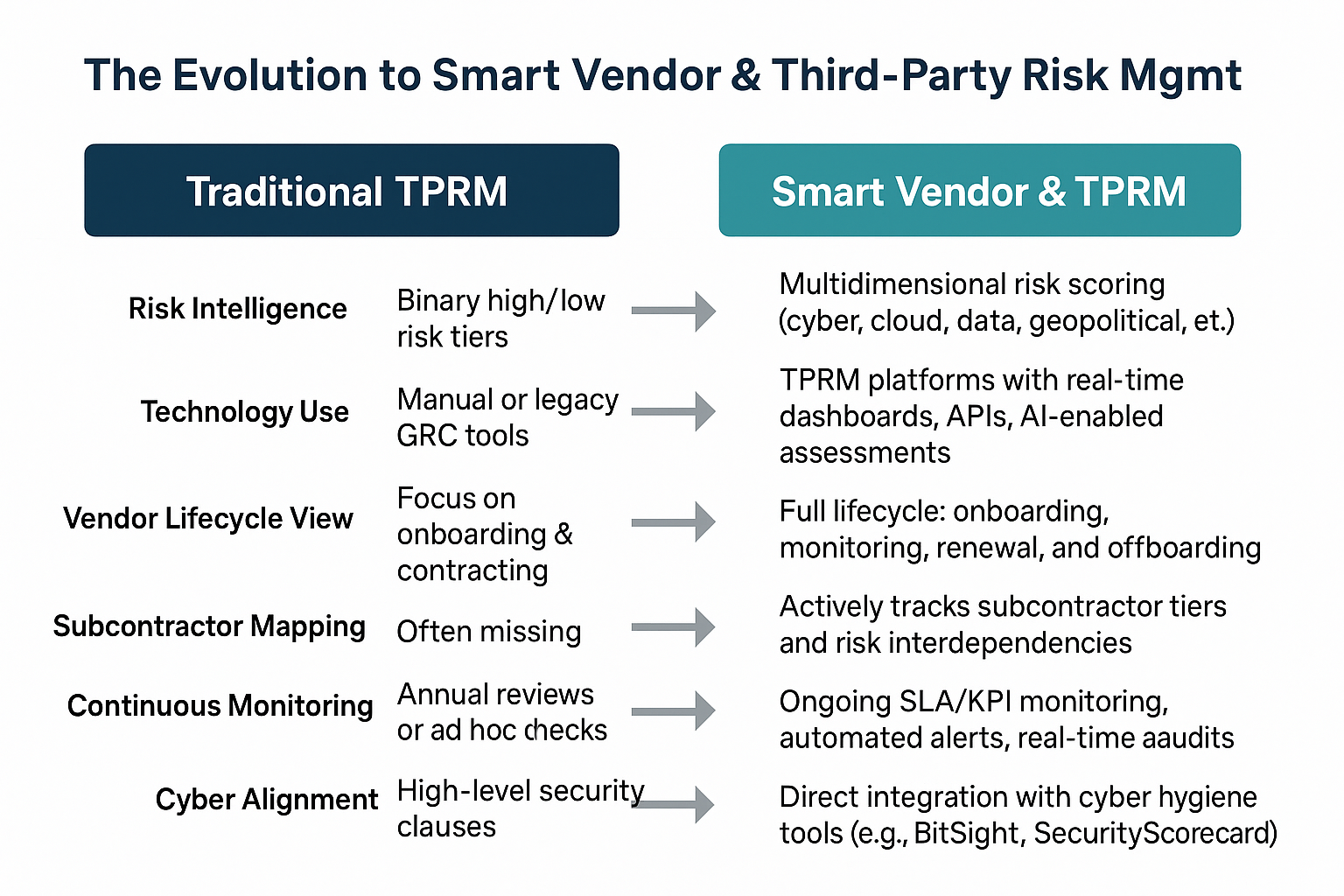

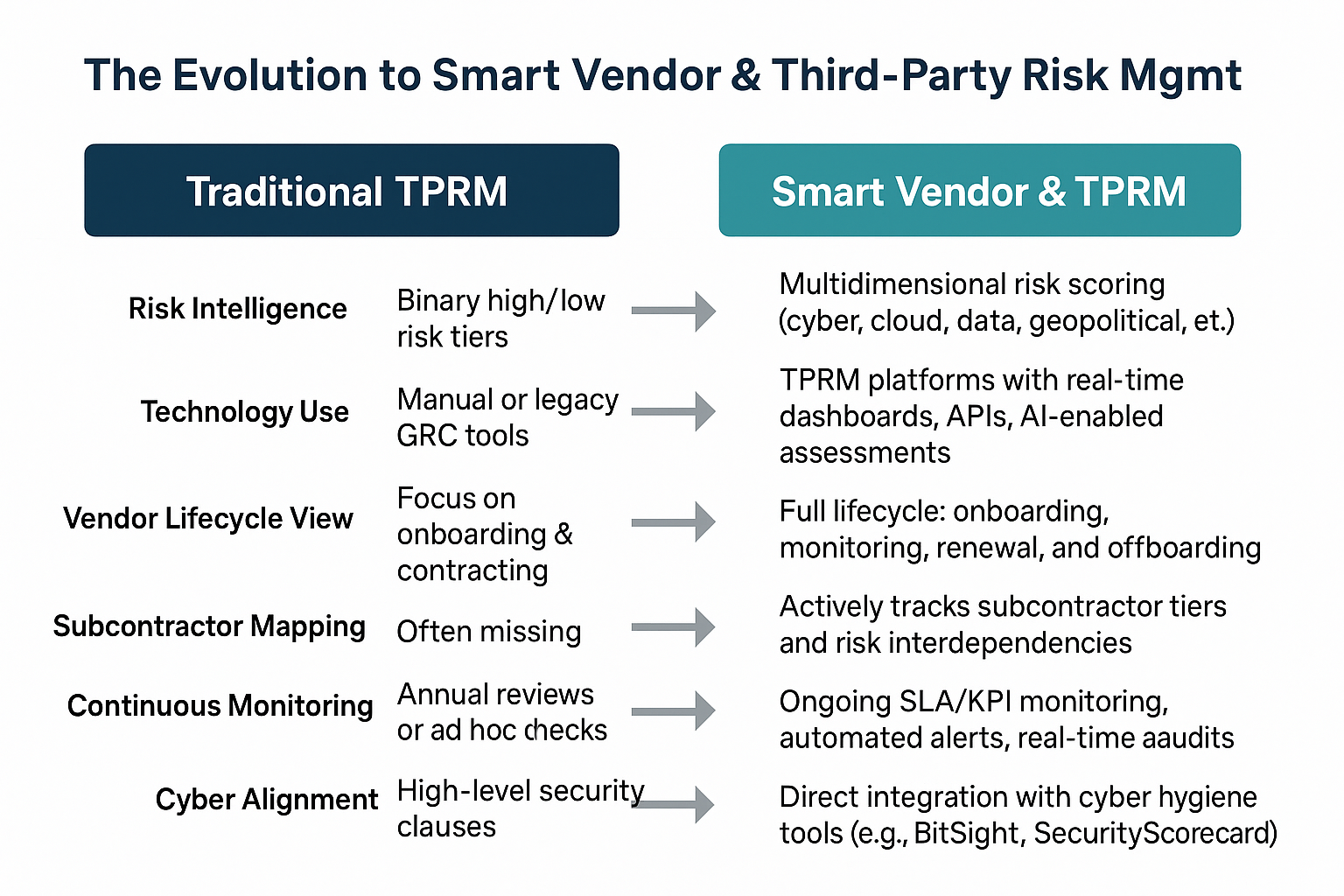

| Feature | Traditional TPRM | Smart Vendor & TPRM |

| Risk Intelligence | Binary high/low risk tiers | Multidimensional risk scoring (cyber, cloud, data, geopolitical, etc.) |

| Technology Use | Manual or legacy GRC tools | TPRM platforms with real-time dashboards, APIs, AI-enabled assessments |

| Vendor Lifecycle View | Focus on onboarding & contracting | Full lifecycle: onboarding, monitoring, renewal, and offboarding |

| Subcontractor Mapping | Often missing | Actively tracks subcontractor tiers and risk interdependencies |

| Continuous Monitoring | Annual reviews or ad hoc checks | Ongoing SLA / KPI monitoring, automated alerts, real-time audits |

| Cyber Alignment | High-level security clauses | Direct integration with cyber hygiene tools (e.g., BitSight, SecurityScorecard) |

| Regulatory Adaptability | Static compliance checks | Built to adapt to regulatory and risk frameworks such as OSFI B-10, DORA, NIST, etc. |

Share your views on Smart TPRM. Which stage of the Smart TPRM journey are you in? Which parts of the journey are more important according to you? And which ones appear to be more challenging?

Let’s connect and discuss.

About This Article

This article is compiled by Financial Technology Frontiers, based on its industry research on the evolving trends in Third-Party Risk Management (TPRM), in the light of AI-driven advancements, and the increasing regulatory oversight demands by regulators across the world. Written in an accessible format, this article’s aim is to raise awareness about developments of TPRM in the financial services industry, globally. FTF believes that both financial service providers and technology companies can benefit from this article and ponder over their respective programs to support this change.

About Financial Technology Frontiers

Financial Technology Frontiers (FTF) is a global media-led fintech platform dedicated to building and nurturing innovation ecosystems. We bring together thought leaders, financial institutions, fintech disruptors, and technology pioneers to drive meaningful change in the financial services industry.

Editorial Credits: Narasimham Nittala.