Cyber insurance has always been a grey area for businesses with a limited understanding of Underwriting, Risk Management, making the choice of policies, pricing, processes, claims, and much more.

Tag: video

Advisor-Digital and Process transformation

Mr. Jitendra Agrawal, the advisor on board at Financial Technology Frontiers, who is a noted digital transformation specialist with the lineage of HDFC Life, ICICI Bank, and many other technologies as well as financial institutions, shares his perspective on digital transformation with Babu Nair, Publisher Banking Frontiers. Jitendra discusses RPA, OCR Technology, Voice Solutions, AI, chatbot, voice bot,

Elevating Inclusive Fintech – Pat Patel

Elevandi Executive Director and Head, Pat Patel discusses with Babu Nair, Founder & MD of Financial Technology Frontiers, about organizing discussion forums and creating larger ones for people to associate,

Fortifying Foundations- Harnessing Innovations – Yogesh Sangle

In this video, which is part of the payment leadership series, Babu Nair, Founder & MD of Financial Technology Frontiers, discusses with Yogesh Sangle, Global Head of Consumer Business at NIUM,

Digital Pilipinas – Engaging Global Facilitating Glocal – Amor Maclang

Amor Maclang, convener of the Philippines Fintech Festival and head of Digital Pilipinas, discusses with Babu Nair, founder of Banking Frontiers and Financial Technology Frontiers, about the marvelous growth opportunities in the fintech sector. She highlights the inspiring work of building newer communities and engaging in global alliances to support the growth of

fintechs from the Philippines and global players in the country. Maclang also shares insights on the in-demand technologies and areas requiring more innovations, as well as the association’s efforts to work with regulators and the government to create a conducive environment for fintechs.

Keep watching for more insights!

Nurturing Paytech With Valleyfintechpay – Lanny Byers and Sumit Arora

Paolo Sironi, Global Research Leader in Banking and Financial Markets, IBM Consulting, explains how organizations have been transforming from output to outcome-based economies. He shares how achieving one’s financial, personal, and professional goals is a valuable asset and the role of value insight creation in enabling contextual and conscious banking. He talks about how enriching customer insights can have enhanced value due to digital transparency and trust-based technology. He throws light on how an ecosystem of open transparency fosters stronger technological ties while deliberating the potential of banks and fintech to enable and unlock better values.

From Fintech To Embedded Fintech – Amee Parbhoo

An in-depth discussion with Mike Robertson, CEO, and Co-Founder of AbbeyCross, Adrian Brown, COO and Co-Founder of AbbeyCross, Babu Nair, MD and CEO of Banking Frontiers & Financial Technology Frontiers dives deeper into the areas of weakness in the global payment infrastructure and how banks are bringing in efficiency while managing the costs.

They also discussed the existing infrastructure models within banks’ processes, as well as the key technology drivers.

Furthermore, they discussed their experiences with vendors and bank engagement channels, as well as the importance of data documentation prior to vendor onboarding.

Frontiers in Cyber Insurance | Interview with Jennifer Wilson | FinTech Frontiers Live

An insightful conversation between Jennifer Wilson, SVP, Cyber Practice Leader, Hub International, and Babu Nair, Founder and MD of Financial Technology Frontiers, reveals how cyber insurance has changed from pre- to post-pandemic times. As a specialist in cyber insurance, she speaks about network security, price behavior, cyberterrorism, and policy execution. Moreover, she discusses the importance of multi-factor authentication, the scope of automation in cyber insurance, and the role of technology investment in this area. Keep watching!

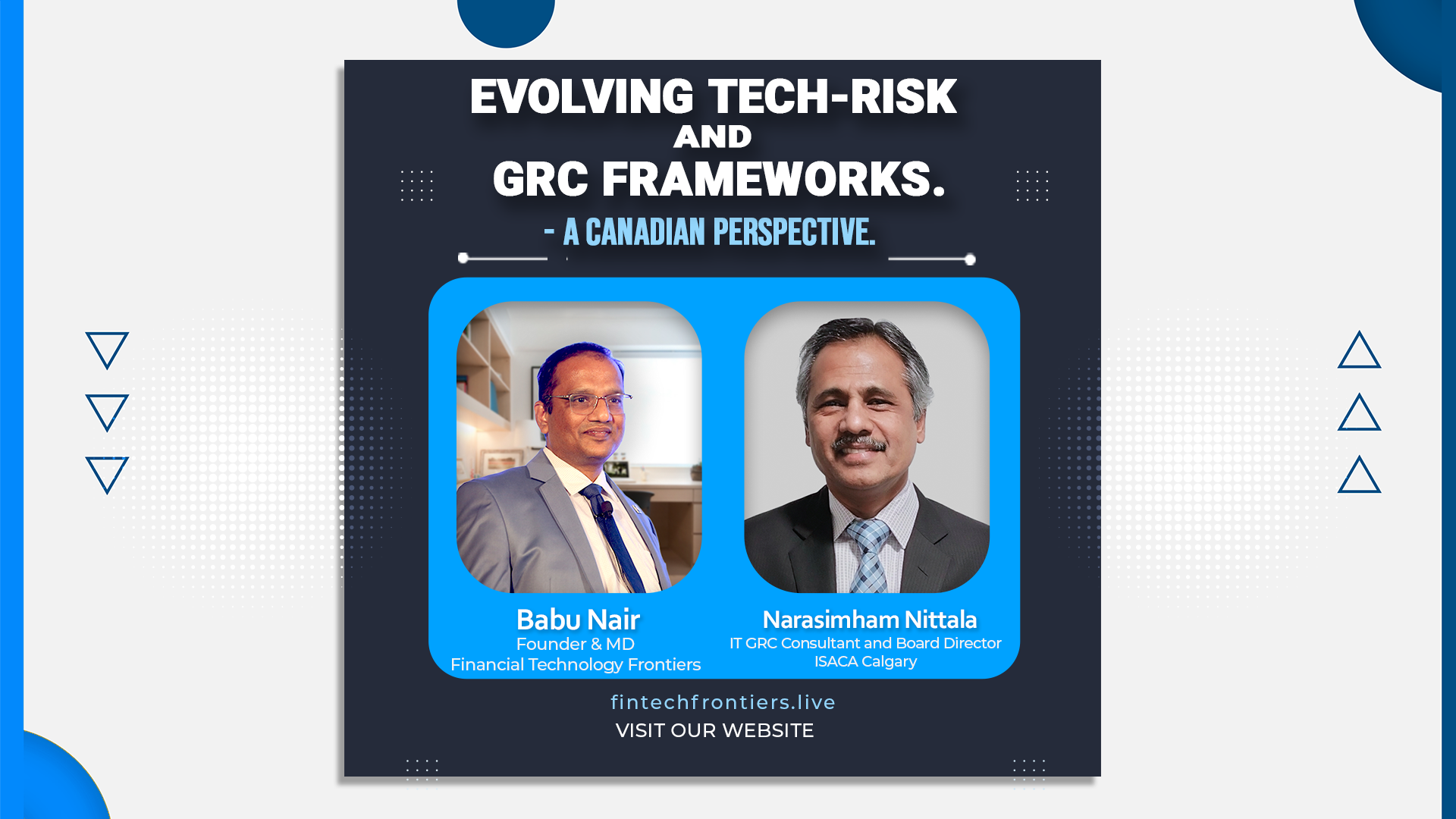

Evolving Tech Risk & GRC Frameworks by Narasimham Nittala | FinTech Frontiers Live

Evolving Tech Risk & GRC Frameworks by Narasimham Nittala | Fintech Frontiers Live

Re-Thinking Cross Border Payment Infrastructure | FinTech Frontiers Live

An in-depth discussion with Mike Robertson, CEO, and Co-Founder of AbbeyCross, Adrian Brown, COO and Co-Founder of AbbeyCross, Babu Nair, MD and CEO of Banking Frontiers & Financial Technology Frontiers dives deeper into the areas of weakness in the global payment infrastructure and how banks are bringing in efficiency while managing the costs.

They also discussed the existing infrastructure models within banks’ processes, as well as the key technology drivers.

Furthermore, they discussed their experiences with vendors and bank engagement channels, as well as the importance of data documentation prior to vendor onboarding.