National Australia Bank believes moving to the cloud is crucial for the effectiveness of digital transformation:

Australia has a distinction in that 4 out of 5 customers of banks prefer digital transactions using digital devices. Naturally, one of the largest banks in the country, National Australia Bank, or NAB, is a leader in digitization, investing heavily in major digital initiatives. In this, the bank has followed a dual strategy focusing on digitizing the employee experience along with customer experience. Its effort is to put the customers and colleagues in an equal position at the top of the organization.

The bank is a major provider of personal, business and private banking services. It has presence in Australia, New Zealand, the US, Hong Kong, the UK, Singapore, Japan, China and India. Headquartered in Melbourne, Victoria, the bank has most of its functions digitized and is a pioneer in the use of AI and cloud.

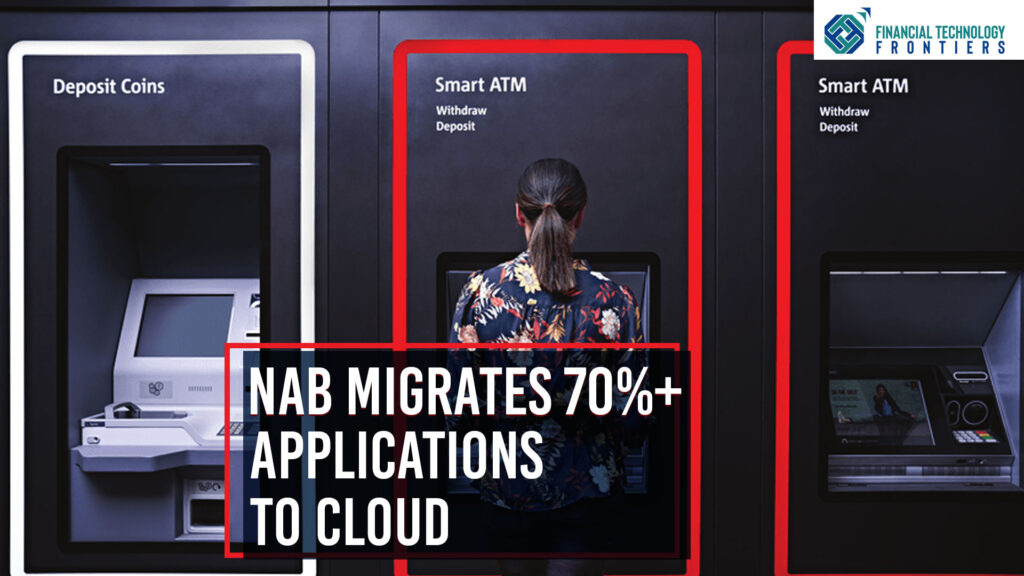

MULTI-CLOUD STRATEGY

The bank has a multimillion-dollar, long-term deal with Amazon Web Services to help it in its cloud-first technology strategy. It has adopted a multi-cloud approach, which has seen it become a market-leader in the transition to the cloud. AWS helps the bank to accelerate its migration of key critical workloads to the cloud as the bank will have access to the latest innovations, including AWS Graviton processors designed to deliver the best price-to-performance for cloud workloads. Many of its products and services, including the home loans, internet banking, NAB Connect online business platform, and NAB Now Pay Later product are all now enabled by the cloud. It has moved more than 70% of its applications to cloud and become the first major Australian bank to have its business banking online platform – Global FX & Trading Platform (Murex) – in the cloud. It is now part of the Global Open Finance Challenge initiated by AWS and 3 other global banks.

The bank is also using Amazon Connect, the omnichannel cloud contact center that uses AI to match NAB customers to the most appropriate, highly-skilled, Australia-based contact center team member. Customers can call using a button within the internet banking app and be fully authenticated without having to go through a list of personal questions on the phone.

TEXT INTO VOICE

Another unique service that the bank is using – Amazon Polly – turns text into life-like speech and the bank’s customers are greeted by a voice that is powered by AI smarts that represents a brand’s persona. The voice is described as ‘uniquely NAB and consistent with the bank’s position and what its customers expect when they call the bank’.

Amazon Polly uses a deep learning model that enables voices to acquire intonation patterns from natural speech data and reproduces utterances in a similar style or tone.

ATM KEY SOURCE

One of the novel uses of the cloud by the bank is to leverage AI in identifying customers at an ATM through facial recognition. This improves the customer experience by removing the need for a physical card while also reducing the risk of card fraud and skimming. The AI-powered ATM is a cloud-based proof of concept developed using Microsoft Azure cognitive services.

NAB had set up NAB Labs some 5 years ago with the aim of introducing newer products to take on competitors like fintechs. The tech team at the facility developed QuickBiz, which is claimed to be the world’s first fully automated SME lending decision proposition from a bank. What is unique about QuickBiz is that it makes use of third-party data like transactions from open banking, accounting, and e-commerce software and offers SME customers unsecured amortising loans, with the full application and approval process taking less than 20 minutes and cash made available the next day.

ENHANCED CREDIT SUPPLY

The bank has a partnership with Rich Data, an Australian AI firm, in developing an AI-based credit decisioning system that is expected to increase the supply of credit by widening the pool of small businesses that can qualify for a loan. NAB is now able to carry out real-time loan assessments, tapping data from cloud accounting platforms, transaction systems and other macroeconomic sources to profile small to medium enterprises and predict their likelihood of repayment.

While the digital banking program is at the heart of the bank’s transformation agenda, the bank has in parallel been overhauling its total technology environment. It has upgraded its networks through a partnership with Telstra, modernized its voice platforms, and has transformed is printing services with the help of Microsoft and IBM reducing the use of printers across the country.

There is also a new data center, which is world-leading in terms of energy consumption and which is the first Australian facility to achieve the US Green Building Council Platinum Certification. – an award specific to data centres. The data center also houses the bank’s new Private Cloud, an infrastructure on-demand capability constructed with IBM.

This article has been compiled based on publicly available information on the web, particularly the bank’s own website.

Read more: