In line with the vision of Sheikh Mansour bin Zayed Al Nahyan, Deputy Prime Minister and Minister of the Presidential Court, and Chairman of the Central Bank of the UAE’s (CBUAE) Board of Directors, the CBUAE has launched its Financial Infrastructure Transformation (FIT) programme.

The FIT programme looks to accelerate digital transformation in the financial services sector as part of a wider strategy aimed at enabling the CBUAE to be among the top central banks globally. It aims to support the financial services sector, promote digital transactions, and enable the UAE’s competitiveness to become the financial and digital payment hub and a centre of excellence for innovation and digital transformation through encouraging innovation and collaboration as well as competition in the financial sector. The programme comprises implementation of nine key initiatives.

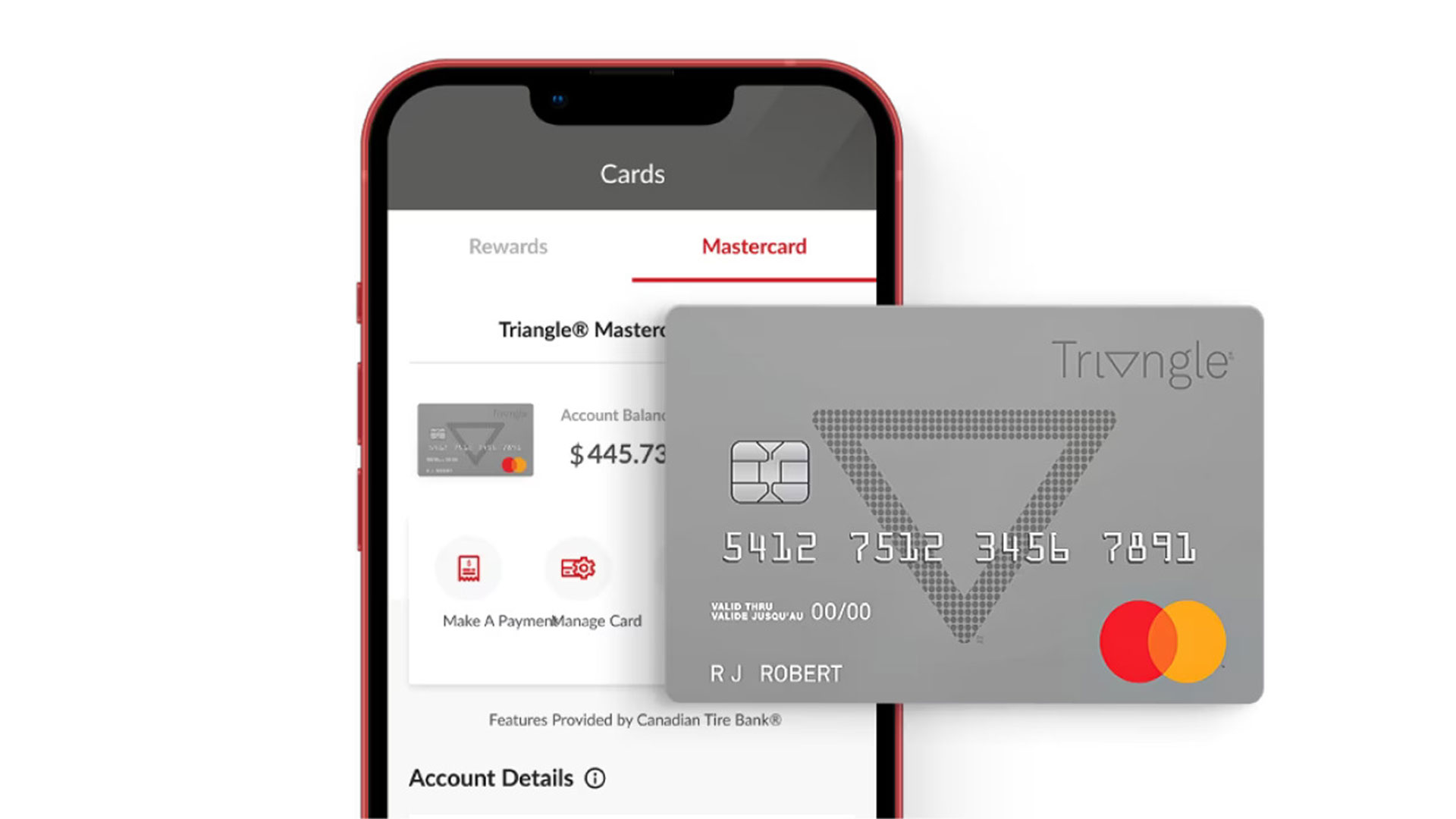

The first stage includes a series of digital payment infrastructures and services such as the launch of a Card Domestic Scheme, an Instant Payments Platform, and the issuance of Central Bank Digital Currency for cross-border and domestic uses. These digital payment initiatives will drive financial inclusion, promote payment innovation, security, and efficiency, and achieve a cashless society.