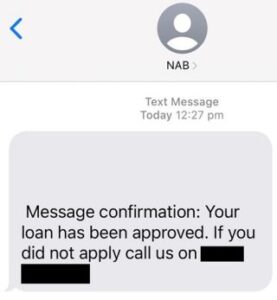

National Australia Bank (NAB) has taken new measures to protect customers from spoofing scams – also known as impersonation scams. This is a part of the bank’s initiatives to stop criminals infiltrating bank phone numbers and text message threads.

Working with telecommunications providers, NAB is placing bank phone numbers on the ‘Do Not Originate’ list to help reduce scam calls impersonating NAB numbers. Going further to protect customers, the bank has also added additional protections to reduce scam messages appearing in legitimate bank text message threads.

Since implementing changes in late December, NAB has seen a 50% reduction in these types of spoofing cases, leading to a 70% reduction in customer losses. NAB Executive for Group Investigations and Fraud, Chris Sheehan, said these actions would make it harder for the criminals behind the scams but more work was needed, and customers must remain vigilant.

“Scams impersonating NAB and other recognised brands have continued to rise, and it’s clear we need more collaboration across business sectors to stop this occurring,” Sheehan said. “Last year we saw a 38 per cent rise in scam reports from our customers. We take around 130,000 calls from customers every month and we’ve added around 140 people to the team who handle these calls so we can help people faster,” he said. “Although we prevented more than $110m in scam losses for our customers last year, too many people are still falling victim and losing large amounts of money.”